With the digital world constantly evolving, the ways we manage our finances are changing too. Cash App is a leading mobile payment service that allows users to transact money conveniently using their smartphones. Adding a credit card to your Cash App can enhance your payment options, making it easier to send money, make purchases, or even invest in stocks and cryptocurrencies directly from your app. Let’s walk through the seamless process that allows you to add a credit card to your Cash App, equipping you with yet another tool in your financial toolkit.

Linking a New Credit Card

Before diving into the steps, it’s essential to understand that linking a new credit card to your Cash App can be a beneficial move. This integration expands your payment options, which is particularly useful for transactions that require a credit card.

Detailed Steps:

- Open the Cash App on your smartphone.

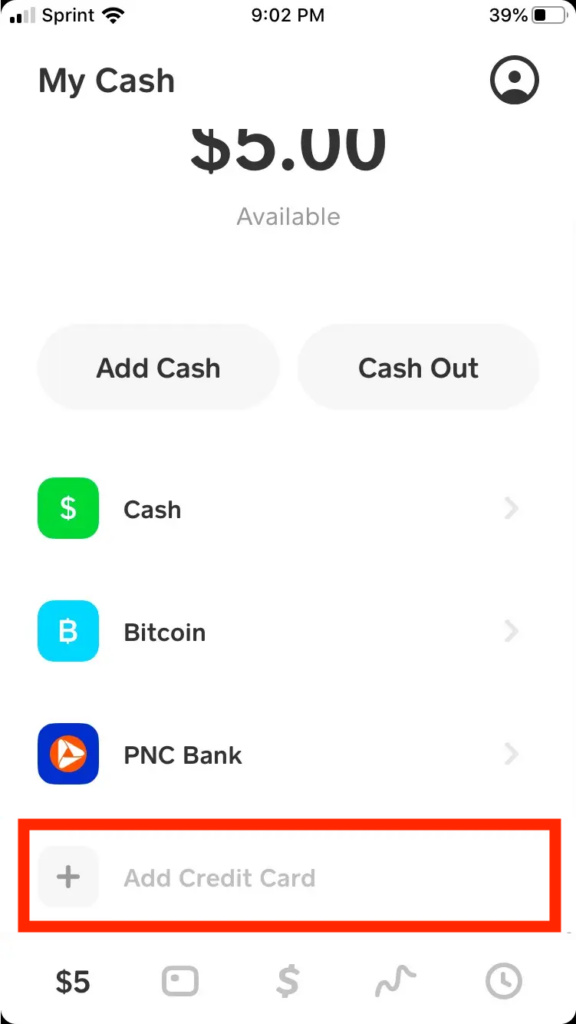

- Tap on the “My Cash” tab, symbolized by a building icon in the lower-left corner of the home screen.

- Scroll down to the “Credit Cards” section and tap on “Add Credit Card.”

- Enter your credit card number, expiration date, CVV, and ZIP code.

- Tap “Add Card” to link your credit card to your Cash App account.

Summary:

Adding a new credit card offers the convenience of a broader range of payment options. However, keep in mind that there is a 3% fee for sending money using a credit card, and always be cautious of your personal information security.

Verifying Your Card

Once a card is added, Cash App might require verification. It’s a security measure to prevent unauthorized usage and to ensure that the card belongs to you.

Detailed Steps:

- After adding your credit card, if prompted, enter any additional required information to verify your card.

- This might include answering security questions or confirming small test transactions made by Cash App.

Summary:

Verification bolsters security, giving you peace of mind. The downside is the potential inconvenience if additional steps are required beyond the standard card information.

Setting as Default Payment

For regular Cash App users, setting your credit card as the default payment method can streamline your experience.

Detailed Steps:

- Go to the “My Cash” tab.

- Under “My Cash,” select your credit card.

- Choose “Set as Default” to make your credit card your default payment method.

Summary:

This offers the benefit of faster transactions without having to choose a payment method each time. Remember, using your credit card may incur additional fees.

Removing a Card

If you ever need to remove your credit card, perhaps because it’s expired or if you prefer not to use it, the process is straightforward.

Detailed Steps:

- Navigate to the “My Cash” tab.

- Select the credit card you want to remove.

- Scroll down and select “Remove Card.”

Summary:

Removing a card can help manage your digital wallet and stay organized. The downside is the loss of a payment option until you add a replacement card.

Updating Card Information

Should your credit card information change due to a lost card or expiration, updating it is simple.

Detailed Steps:

- Go to the “My Cash” tab and select your credit card.

- Choose “Remove Card” and then add the card again with the updated information.

Summary:

Keeping card information current is crucial for uninterrupted service. It ensures you’re ready for transactions without delay.

Troubleshooting Declines

If your card is declined, it might be due to several reasons, such as incorrect information, insufficient funds, or your bank not authorizing the transaction.

Detailed Steps:

- Verify that the card information entered in Cash App is correct.

- Check with your bank to ensure they permit transactions on Cash App.

- Ensure you have adequate credit available.

Summary:

Troubleshooting is key to a hassle-free experience. By addressing declines promptly, you maintain continuous access to your funds.

Understanding Fees

Being aware of potential fees associated with using a credit card on Cash App can save you from unexpected charges.

Detailed Steps:

- Open the Cash App and tap on the profile icon.

- Scroll to the “Funds” section and select “Credit Card.”

- Read the information regarding fees.

Summary:

Understanding fees helps manage your finances better and avoid surprises. However, fees can make frequent use of a credit card on Cash App less appealing.

Security and Privacy

Cash App takes your security seriously. It is essential to understand the measures in place to safeguard your information.

Detailed Steps:

- Regularly review your Cash App settings and permissions.

- Consider enabling additional security features such as two-factor authentication.

Summary:

Safety features protect your financial data, but remaining vigilant against potential scams or unauthorized access is crucial.

Contacting Support

If you face any issues while adding your credit card, Cash App’s support team is there to help.

Detailed Steps:

- Tap the profile icon on your Cash App home screen.

- Scroll down and select “Cash Support.”

- Choose “Something Else” and navigate your issue.

Summary:

Access to support provides reassurance but may take time for response and resolution.

Cash Card Advantages

Consider ordering a Cash Card, which is a customizable debit card linked to your Cash App balance and can offer unique boosts and savings.

Detailed Steps:

- Go to the “Cash Card” tab and tap “Get Free Cash Card.”

- Customize your card and tap “Continue” to order.

Summary:

A Cash Card grants access to exclusive discounts but note it draws from your Cash App balance, not your credit card.

In conclusion, integrating a credit card into your Cash App can enhance your financial flexibility, allowing for immediate payments and expanded services. As simple as the process may be, it is essential to remain informed about fees, security, and the terms of service to avoid any pitfalls. With the right knowledge, Cash App can become an even more powerful tool in your digital financial repertoire.

FAQs

Q: Will adding a credit card to Cash App impact my credit score?

A: No, adding a credit card does not impact your credit score. However, if you use the credit card to make transactions, it might affect your score depending on your usage and repayment.

Q: Can I use an international credit card on Cash App?

A: Cash App generally requires a U.S.-issued card. International credit cards might not be supported.

Q: Is it safe to link a credit card to Cash App?

A: Yes, linking a credit card is safe as Cash App uses encryption and fraud detection technology. Always ensure your app is updated and follow security practices for added protection.