Managing your finances digitally has become increasingly simple, thanks to apps like Cash App that facilitate easy transactions. Adding a credit card to your Cash App is a straightforward process that allows you to fund transfers, make purchases and even invest in stocks or cryptocurrency from your smartphone. Knowing how to link your credit card correctly is essential for taking full advantage of Cash App’s features. Below you’ll find a series of steps and advice to add your credit card seamlessly, along with tips to ensure a smooth financial experience within the app.

Linking a Credit Card

To utilize all the capabilities of Cash App, linking your credit card is a key step. This action allows you to directly fund your Cash App balance and transact effortlessly.

Detailed Steps:

- Open Cash App on your mobile device.

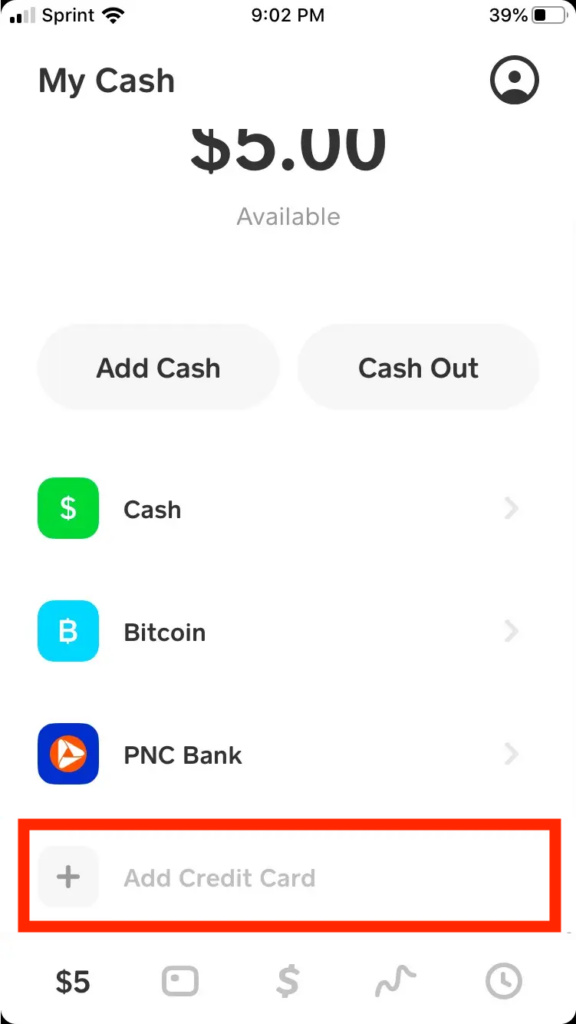

- Tap the ‘My Cash’ tab, which is the icon with a dollar sign located on the bottom left corner of the screen.

- Under the ‘Cash and Bitcoin’ section, select the ‘+ Add Credit Card’ option underneath your existing bank account information.

- Enter your credit card number by typing it into the corresponding field.

- Fill in your credit card’s expiration date, CVV code, and ZIP code.

- Confirm the addition by tapping ‘Add Card.’

Summary

Adding your credit card enables instant transactions. However, remember that Cash App charges a 3% fee for credit card transactions, while debit card transfers remain free.

Adjusting Card Details

Once your card is added, you might need to update or correct certain information to ensure your card works perfectly with the app.

Detailed Steps:

- Open Cash App on your device.

- Access the ‘My Cash’ tab by tapping the corresponding icon.

- Select your credit card under the ‘Cash and Bitcoin’ heading.

- Tap ‘…’ to reveal additional options and then press ‘Remove Card’ or ‘Replace Card’ based on your needs.

- Update the new card details including the number, expiration date, CVV, and ZIP code if you are replacing the card.

- Confirm the updates to save the new card information.

Summary

Keeping card information accurate is critical for smooth transactions. There’s no cost to update card details, but input errors can lead to declined transactions.

Verifying the Card

Cash App may require verification to ensure the credit card belongs to you, adding a layer of security to your transactions.

Detailed Steps:

- Upon adding or updating your card, watch for a prompt asking for additional verification.

- Follow the in-app instructions which may involve providing further personal information or answering security questions.

- Complete any verification transactions required by Cash App, which typically involve small, refundable charges to your card.

Summary

Verification builds trust in the transaction process, although it may add a brief delay in using your credit card within the app.

Checking for Compatibility

Before adding your card to Cash App, confirm that it’s a supported card. Cash App accepts most major credit cards, but there could be exceptions.

Detailed Steps:

- Visit the Cash App support page to check for compatible credit cards.

- Verify that your card provider and card type are listed as supported.

- If you’re unsure, contact Cash App support or your card provider for clarification.

- Proceed with adding your card once compatibility is confirmed.

Summary

Verifying compatibility prevents failed attempts to add unsupported cards, saving you time and potential frustration.

Double-Checking Security Measures

Adding a credit card to any digital platform should be handled securely to prevent unauthorized usage or data breaches.

Detailed Steps:

- Always ensure your Cash App has a passcode set.

- Double-check that your smartphone has security measures like a fingerprint lock or facial recognition enabled.

- Only proceed with adding a credit card in a secure, private Wi-Fi network, not public hotspots.

Summary

Such precautions minimize risk when adding a credit card but remember no digital platform is entirely risk-free.

Ensuring Sufficient Credit Limit

To use your credit card effectively within Cash App, there should be enough available credit to cover transactions.

Detailed Steps:

- Check your credit card balance and available limit before initiating a transfer or payment on Cash App.

- Consider paying down your card’s balance if necessary to increase your available credit.

- Always keep track of your credit card transactions through your card provider’s app or website.

Summary

Staying within credit limits prevents declined transactions but keep in mind that high credit card utilization might affect your credit score.

Monitoring for Fees

Being aware of Cash App’s fees associated with credit card usage is crucial to managing your finances effectively.

Detailed Steps:

- Review Cash App’s fee structure for credit card transactions by visiting their website or help center.

- Consider using a debit card if you want to avoid fees, as they typically have no added charge for transfers.

- Calculate the cost of transaction fees in advance if you’re planning a larger transfer.

Summary

Monitoring fees can help you keep costs down, but using a credit card on Cash App could be more convenient despite the fees.

Understanding Limits

Cash App has certain limits on how much money you can send or receive, which might vary with credit card transactions.

Detailed Steps:

- Familiarize yourself with Cash App’s limits by checking their support resources online.

- Keep the limits in mind when planning to make transactions with your linked credit card.

- Contact Cash App support if you need to request an increase in your limits.

Summary

Understanding these limits can prevent transaction issues, but sudden changes in your activity might trigger security checks or delays.

Troubleshooting Declined Transactions

If your credit card transaction on Cash App is declined, you can take steps to troubleshoot the problem.

Detailed Steps:

- Verify that your credit card information is correct and up to date in the app.

- Ensure that your credit card has not expired and has sufficient funds.

- Check if Cash App’s servers are operational or if there might be an outage affecting transactions.

- Contact your credit card provider to ensure they haven’t blocked the transaction for security reasons.

Summary

Troubleshooting is helpful when you face issues, but it’s also crucial to be aware that some problems might require you to contact support for both Cash App and your credit card issuer.

Keeping the App Updated

An outdated Cash App might result in issues with linking your credit card or with transactions, so maintaining the latest version of the app is beneficial.

Detailed Steps:

- Check the App Store (for iOS devices) or Google Play Store (for Android devices) to see if there’s an update available for Cash App.

- Download and install any updates to ensure the app is current.

- Restart your app after updating to apply any new changes or fixes.

Summary

Running an updated version of Cash App ensures better security and performance. However, facing issues immediately after an update may require you to clear the app’s cache or contact support.

In conclusion, linking a credit card to your Cash App enhances the app’s versatility and makes digital transactions more convenient. By following the outlined steps, you can ensure your card is added properly and set up for use with minimal trouble. Regularly review your credit card information within the app for accuracy, note any applicable fees, and stay informed about security features to keep your finances safe in the digital realm.

Frequently Asked Questions

Q: Can I link multiple credit cards to my Cash App?

A: Cash App typically allows users to link one credit card at a time. If you want to use another card, you’ll need to replace the existing one.

Q: What should I do if my credit card isn’t accepted by Cash App?

A: First, confirm that your card is a Visa, MasterCard, American Express, or Discover as these are generally accepted. If it’s still not being accepted, reach out to Cash App support for assistance.

Q: Are there any risks in linking my credit card to Cash App?

A: As with any financial app, there is a small risk of unauthorized use if your account information is compromised. Ensure you follow best security practices like using a strong password and enabling two-factor authentication to mitigate these risks.