Introduction

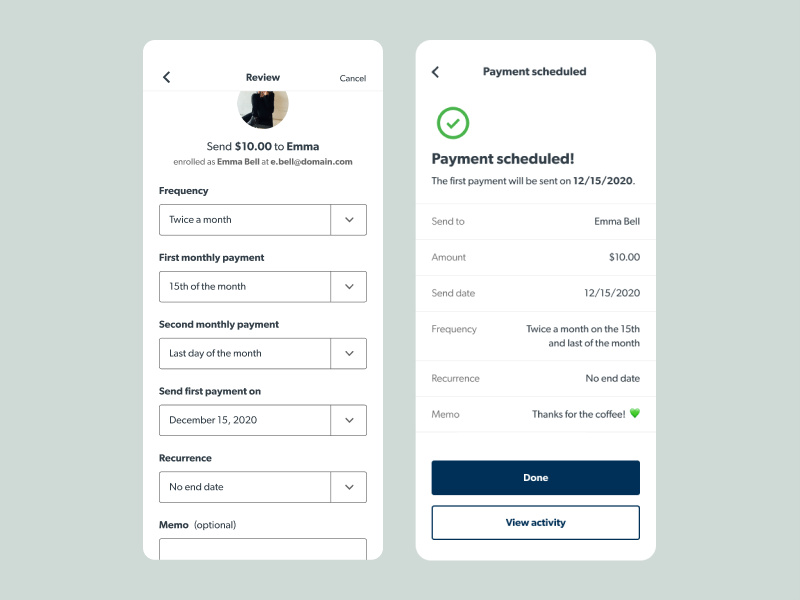

In our fast-paced world, managing finances efficiently is crucial. One way to streamline your money matters is by setting up recurring payments, which can save time and help avoid missed payments. If you’re a Zelle user, you might be wondering how to utilize this feature for your regular transactions. Zelle is known for its ease and speed in peer-to-peer transactions, but setting up recurring payments might seem daunting if you’re not well-versed with the app. Fear not, as this comprehensive guide will walk you through the process, making it simple enough that even those with no technical background can follow along seamlessly.

Automatic Bill Pay through Your Bank’s Zelle Service

Many banks offer bill payment services through their online portals, integrating with Zelle to transfer funds. While Zelle itself doesn’t have a recurring payment feature built-in, you can set up regular payments to Zelle recipients using your bank’s bill pay service.

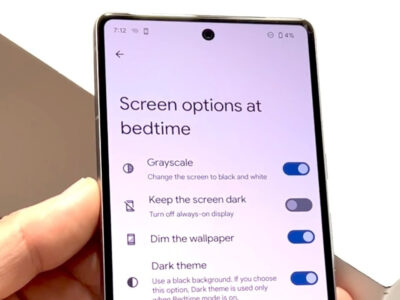

- Log in to your online banking or mobile banking app.

- Navigate to the Bill Pay section.

- Add a new payee using the recipient’s email address or phone number associated with their Zelle account.

- Choose the option to set up an automatic or recurring payment.

- Enter the payment details, such as the start date, frequency, and amount.

- Review the information, then confirm and submit the scheduled payment.

By using your bank’s bill pay feature, you can automate payments without needing to remember them each time. However, this is only feasible if the recipient is set up to receive payments via Zelle.

Scheduled Transfers via Third-Party Apps

Certain third-party financial tools and apps allow you to schedule transfers between your accounts and other users. While not directly a feature of Zelle, these tools can send scheduled payments to your recipients.

- Research and select a reputable third-party financial app that supports scheduled transfers and works with Zelle.

- Download and install the app, then create an account.

- Link your bank account or debit card to the app.

- Set up a new scheduled payment, entering the recipient’s Zelle-linked email or phone number.

- Specify the payment frequency, date, and amount.

- Confirm and save your scheduled payment.

Using third-party apps can be helpful, but it’s crucial to ensure they are secure and trusted to handle your financial transactions.

Financial Planning Software Integration

Some financial planning software packages include the capability to manage bill payments, and they may allow for scheduling of payments through Zelle.

- Find and subscribe to suitable financial planning software.

- Confirm that it supports scheduling payments to Zelle users.

- Set up your account and link your bank information.

- Create a new automated bill payment entering the Zelle recipient’s details.

- Select the frequency, amount, and payment dates.

- Confirm and activate the recurring payment feature.

With financial planning software, you have the added benefit of tracking your spending and budget alongside your recurring payments.

Calendar Reminders for Manual Payments

If you prefer a more hands-on approach or your bank and Zelle don’t offer automated options, setting calendar reminders is a useful way to remember to send payments manually on a regular basis.

- Open your digital calendar (such as Google Calendar, Outlook, etc.).

- Create a new event on the date and time you need to make your first payment.

- Set the event to repeat at the required frequency (weekly, monthly, etc.).

- Include a reminder notification for the day before, or a few hours before, the payment is due.

- When you receive the reminder, manually initiate a Zelle payment to the intended recipient.

This method requires discipline and consistency, but it ensures you won’t forget to make important payments.

Peer-to-Peer Payment Scheduler

A Peer-to-Peer (P2P) payment scheduler is a dedicated service or app that specializes in scheduling and managing P2P transactions. It might be compatible with Zelle to some extent.

- Search for a P2P payment scheduler that works with Zelle.

- Download the program or app and create an account.

- Link your Zelle account and set up your banking information.

- Arrange a new payment, input the recipient’s information, and specify the schedule.

- Verify the details and activate the recurring payment.

Always prioritize security when dealing with financial services or apps and check the compatibility with Zelle before starting.

Direct Debit Set-Up with Recipients

For regular payments like rent, you might be able to set up a direct debit from your bank account to the recipient’s account.

- Discuss with your payment recipient about setting up a direct debit.

- Obtain the necessary authorization forms and bank details.

- Complete and sign the forms, then submit them to the relevant bank or financial institution.

- Verify that the direct debit is active and the recipient is set up on Zelle to receive payments.

Direct debit is a set-it-and-forget-it solution, ensuring timely payments without the need for manual intervention.

Online Budget Tools

Some online budgeting tools can manage recurring payments as part of their service. Explore how these tools can assist with Zelle payments.

- Choose a budgeting tool that allows for the management of recurring payments.

- Sign up and link your bank account that is connected to your Zelle profile.

- Schedule recurring payments within the tool, ensuring the funds go to your recipient’s Zelle account.

- Monitor your scheduled payments through the budgeting tool’s interface.

Combining budgeting and payment scheduling helps with financial organization, though these tools may have a learning curve for new users.

Money Management Service Subscription

Consider subscribing to a money management service that includes payment scheduling as one of their features.

- Find a money management service that suits your needs and works with Zelle.

- Sign up for the service, providing all necessary financial information.

- Set up recurrent payments to your Zelle-linked payees within the service platform.

- Keep track of payments using the service’s dashboard and tools.

Money management services often offer robust support for your financial needs, although they may come with subscription fees.

Bank’s Recurring Transfer Feature

If your bank has a recurring transfer feature, utilize it to send scheduled payments to Zelle recipients indirectly.

- Check with your bank to see if they offer recurring transfer services.

- Log into your online banking platform and locate the transfer options.

- Enter your Zelle recipient’s information and set up the transfer as recurring.

- Choose the amount, frequency, and start date.

This approach relies on your bank’s infrastructure and may require setup or maintenance fees.

Financial Advisor Assistance

Engage with a financial advisor to help you set up a system for managing your recurring payments through Zelle.

- Locate a trusted financial advisor experienced with digital payment platforms.

- Discuss your recurring payment needs and explore solutions that leverage Zelle.

- Follow the advisor’s recommendations to set up a sustainable payment schedule.

- Regularly review and adjust the plan with your advisor.

This professional guidance comes at a cost, but it can ensure that your financial strategy is sound and reliable.

Conclusion

Adopting a systematic approach to recurring payments can vastly simplify your financial obligations, ensuring timely transactions without the pressure of remembering each one individually. While Zelle doesn’t directly offer recurring payment features, the solutions and tips provided here illustrate various methods to integrate regular payments with the ease of Zelle’s platform. Choose the option that best suits your comfort level and financial situation to harness the benefits of automated payments, always considering security and reliability when dealing with your hard-earned money.

FAQs

Q: Can I set up recurring payments directly through Zelle?

A: No, Zelle does not currently allow users to set up recurring payments directly in their system. However, you can use your bank’s bill pay service or various other methods and tools to schedule Zelle payments indirectly.

Q: Are third-party apps safe to use for scheduling payments with Zelle?

A: It’s important to do your due diligence and choose third-party apps that are reputable and have robust security measures in place. Always read reviews and check their privacy policies before linking your bank accounts.

Q: Can I automate regular payments to non-Zelle users using these methods?

A: These methods are geared towards recipients who can receive payments via Zelle. If your recipient does not use Zelle, you may need to look into other payment services or methods that your bank offers for recurring payments.