Finding a home is a fundamental need, and for many, income-based apartments offer a viable solution that aligns with their financial situation. These types of housing adjust rent based on the tenant’s income, ensuring that housing costs remain affordable. Each program uses a specific formula to determine exactly how much you should pay, taking into consideration your earnings, family size, and other factors. Understanding how this process works can be crucial in budgeting for your monthly expenses and managing your overall financial health.

Understanding Adjusted Income

Before calculating rent for an income-based apartment, it’s crucial to understand what adjusted income means. Adjusted income is your total household income minus any allowable deductions. This figure is used to determine the exact amount of rent you will be responsible for paying.

Detailed Steps:

-

Identify your total household income: This includes wages, salaries, overtime pay, commissions, fees, tips and bonuses, and other compensation for personal services.

-

List allowable deductions: There are specific deductions that can be subtracted from your total income, such as $480 for each dependent, certain childcare expenses, elderly and disabled allowances, and unreimbursed medical expenses.

-

Calculate your adjusted income: Subtract the allowable deductions from your total household income to acquire your adjusted income.

Summary:

Calculating adjusted income helps to ensure that the rent you pay is based on what you can afford after necessary expenses have been taken into account. This leads to a fairer assessment of rent payment capabilities. However, it may require careful documentation and a clear understanding of what deductions are permitted.

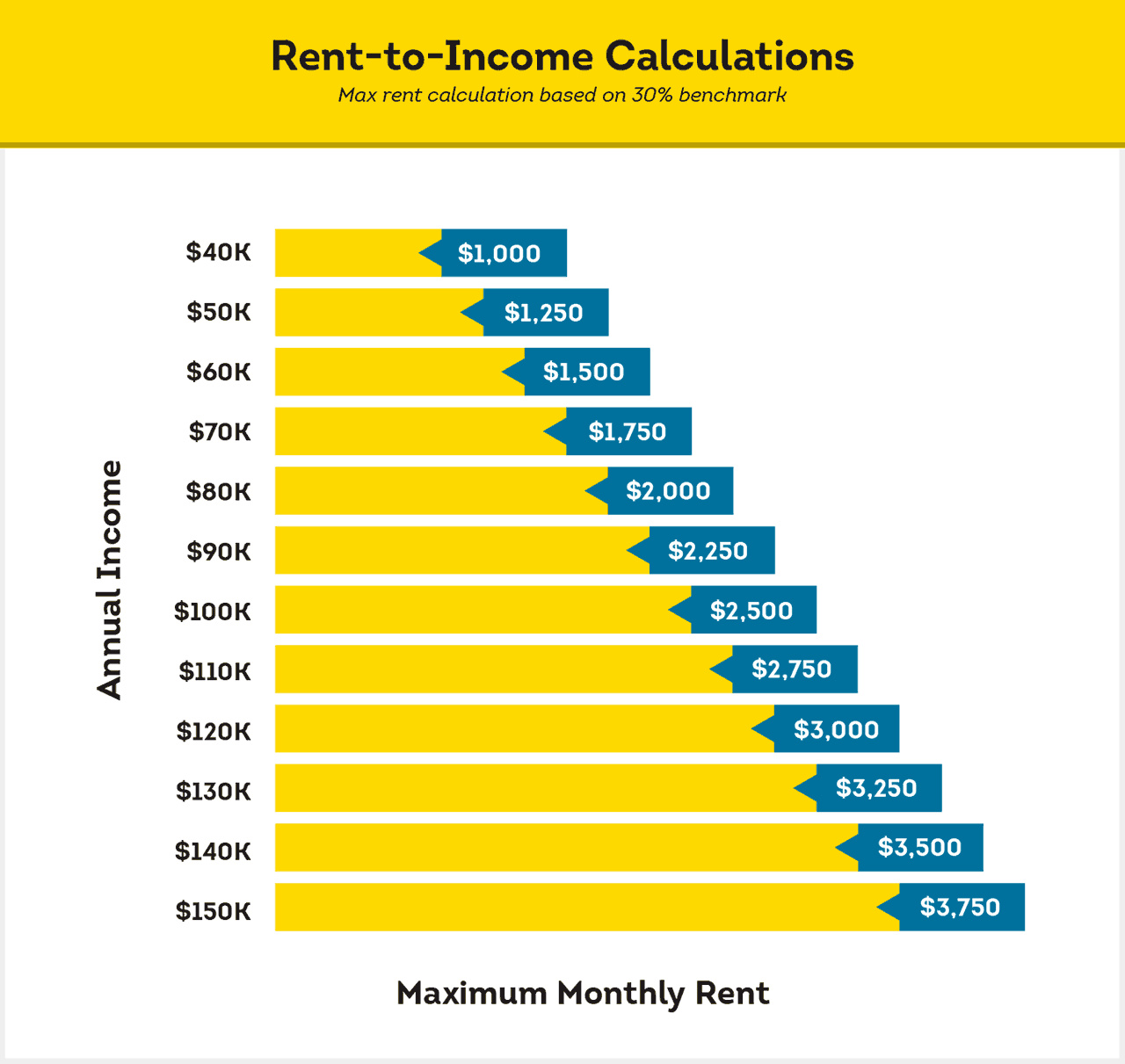

Percentage of Income

Rent in income-based apartments is usually set at a percentage of your adjusted income, typically between 30% to 40%. This ensures that tenants are not overwhelmed by housing costs relative to their earnings.

Detailed Steps:

-

Determine the percentage used by the housing program: Find out the specific percentage your income-based housing program uses.

-

Calculate your rent: Multiply your adjusted income by the determined percentage, then divide by 12 to find out your monthly rent.

Summary:

The advantage of this method is that it scales with your income, potentially lowering your rent if your income decreases. However, it also means that rent can increase if your income rises.

Income Bands

Some programs use income bands to set rent. This method groups households into different income brackets and assigns a fixed rent to each band.

Detailed Steps:

-

Understand the income band structure: Obtain the income band structure from your housing program.

-

Locate your income band: Based on your adjusted income, find where you fall within these bands.

-

Determine rent for your band: Look up the corresponding rent for your income band.

Summary:

Income bands can simplify the rent calculation process and create predictable housing costs. The downside is potential rental jumps when moving between bands with income changes.

Utility Allowances

Some income-based apartments will provide a utility allowance, which is a deduction from your rent to assist with utility payments.

Detailed Steps:

-

Find out if your apartment offers a utility allowance: It’s typically mentioned in the lease or by the property management.

-

Understand your utility allowance: Obtain the exact amount from your landlord or the housing program.

-

Calculate your rent with the allowance: Subtract the utility allowance from the rent you calculated.

Summary:

With a utility allowance, your out-of-pocket cost for housing could be significantly reduced. However, if actual utility costs exceed the allowance, you are responsible for the difference.

Recertification

Your income and family situation can change, so income-based programs require annual recertification to adjust your rent accordingly.

Detailed Steps:

-

Prepare your documentation: Collect recent pay stubs, tax returns, and documentation for deductions.

-

Complete the recertification process: Submit the required documents to your housing program by the deadline.

-

Adjust to new rent amounts: Your rent will be recalculated based on the updated information.

Summary:

Recertification ensures that rent remains affordable and fair. However, it demands administrative work and punctuality each year.

Rent Caps

Many income-based housing has rent caps, which is the maximum amount of rent that can be charged, regardless of the tenant’s income.

Detailed Steps:

-

Learn about the rent cap: This should be disclosed to you by the housing program or landlord.

-

Determine if the cap affects you: If your calculated rent exceeds the cap, your rent should be adjusted down to this maximum.

Summary:

Rent caps ensure that tenants do not pay exorbitant rent, regardless of income scaling. However, it could also mean that available housing is limited, as landlords may be unwilling to participate in the program due to these caps.

Special Cases for Students

For students who may have minimal income or are dependent on financial aid, special considerations may apply.

Detailed Steps:

-

Identify yourself as a student: Ensure that you notify your housing program of your student status.

-

Understand the provisions for students: Each program may have different rules for how student income is treated.

-

Provide necessary documentation: You may have to show proof of enrollment, financial aid, and other income sources.

Summary:

Student-specific rules can make housing affordable for students, yet it can sometimes complicate the application process due to additional eligibility criteria.

Family Size Considerations

Larger families often receive higher income deductions, which can reduce their adjusted income and the rent they owe.

Detailed Steps:

-

Report your family size: Keep your housing program informed of any changes in family size.

-

Understand how family size affects deductions: More dependents usually mean more deductions.

-

Adjust your income and rent calculations: Reflect these changes in your adjusted income and subsequent rent calculations.

Summary:

Family size consideration helps to ensure that larger families are not disproportionately burdened by rent, although it may also necessitate more frequent revision of your housing arrangements.

Working With Housing Counselors

Navigating the nuances of income-based rent calculations can be daunting, but housing counselors can offer guidance and support.

Detailed Steps:

-

Find a housing counselor: Locate a local HUD-approved housing counseling agency.

-

Schedule a consultation: They can help review your income, assist with paperwork, and explain the rent calculation process.

-

Use their expertise: Benefit from their knowledge to make informed decisions about your housing options.

Summary:

Housing counselors can be immensely helpful, providing clarity and assistance throughout the process. Their services may incur a cost, though many offer free counseling sessions.

Local Variations and Subsidies

Each state and municipality may have unique regulations and additional subsidies for income-based housing, affecting how rent is calculated.

Detailed Steps:

-

Research local rules: Seek information from local housing authorities or online resources.

-

Apply for additional subsidies: If available, apply for local subsidies which can further lower your rent.

-

Understand the impact on your rent: Factor in these variations and subsidies to determine your actual rent.

Summary:

Local variations and subsidies can result in even more affordable rent, but it can also add another layer of complexity to the process.

Conclusion

Understanding how rent is calculated in income-based apartments is essential for ensuring that you can find a home that’s not only suitable for your needs but also affordable. While the process may seem complex, breaking it down into discernible steps can make it manageable. With the right guidance, you can navigate the system confidently, making well-informed decisions about your living situation.

FAQs

Q1: Can my income-based rent go up if my income increases?

Yes, since income-based rent is calculated based on a percentage of your adjusted income, rent can increase if your income goes up.

Q2: What happens if I don’t recertify my income each year?

Failing to recertify can result in the loss of income-based rental rates and possible eviction.

Q3: Are income-based apartments the same as section 8 housing?

Not exactly. Income-based apartments are often part of public housing or other affordable housing programs. Section 8, or the Housing Choice Voucher program, is a specific federal program where tenants receive vouchers to help cover rental costs and can choose where to live. While both are aimed at assisting low-income individuals with housing, the application process, qualifications, and operations differ.