Understanding Your Afterpay Account Limit

Navigating the modern landscape of online shopping, you may have come across Afterpay, a service that allows you to purchase items now and pay for them later in installments. It’s a convenient way to manage your budget, but it also raises questions about limitations, such as how many orders you can have at a time. This guide is crafted to demystify that question by providing practical guidelines and tips to help you make the most of your Afterpay experience while maintaining financial responsibility.

Assessing Your Afterpay Account Standing

When using Afterpay, your ability to place multiple orders is influenced by several factors including your payment history and the length of time you’ve been using the service.

Understanding Your Limit

- Review your payment history on your Afterpay account to ensure all past payments were made on time.

- Consider how long you have been an Afterpay user, as longer-term users may have higher limits.

- Check any email correspondence from Afterpay as they sometimes update you about your spending limits.

Evaluating Your Benefits and Downsides

Afterpay’s system of determining how many orders you can have concurrently is designed to encourage responsible spending. While this protects you from accruing unmanageable debt, it may also limit your purchasing flexibility.

Monitoring Your Spending Habits

Keeping an eye on your expenses is crucial with Afterpay to understand your spending patterns and how they impact your order limit.

Tracking Recent Purchases

- Log into your Afterpay account to view your recent purchase history.

- Identify any patterns or trends in your spending that could affect your order limit.

Evaluating Benefits and Downsides

Regular monitoring can help you stay within your budget, but it requires consistent attention to your finances. It empowers you to make informed decisions but can be time-consuming.

Enhancing Your Account’s Reputation

Building a positive track record with Afterpay might lead to increased trust and potentially higher order limits.

Paying On Time

- Always ensure your installment payments are submitted by the due date.

- Set reminders or automatic payments to help manage your installment dates.

Evaluating Benefits and Downsides

Timely payments improve your reputation with Afterpay, increasing the likelihood of having multiple orders approved. However, this approach demands punctuality and careful planning of your finances.

Starting Small

For new users, starting with smaller purchases can be an effective strategy to test the waters with Afterpay while slowly increasing your spending limit.

Gradual Purchases

- Begin with affordable items to ensure you can meet the payment schedule.

- Gradually increase the value of your purchases as your comfort with the platform grows.

Evaluating Benefits and Downsides

This method minimizes financial risk but requires patience and discipline as you build up your credibility with Afterpay.

Understanding Afterpay’s Approval Process

Afterpay doesn’t disclose a specific formula for how it approves transactions, but understanding factors influencing approval can help in managing your orders.

Informed Guesswork

- Review Afterpay’s terms of service for any guidance on approval criteria.

- Experiment with varying purchase amounts to gauge what’s typically approved based on your account history.

Evaluating Benefits and Downsides

Gaining insight into Afterpay’s process can lead to better planning, but it’s still a bit of a guessing game without transparent criteria.

Leveraging Customer Support

Get personalized advice directly from the source by reaching out to Afterpay’s customer support.

Seeking Guidance

- Contact customer support via the Afterpay help page for inquiries on your order capacity.

- Discuss your usage pattern with a representative for tailor-made advice.

Evaluating Benefits and Downsides

Personalized support can offer valuable insights and advice, but it might not provide specific order limit numbers due to privacy policies and varying customer profiles.

Considering Affordability

It’s essential to only spend what you can afford to repay, regardless of your Afterpay limit.

Budgeting

- Create a monthly budget that includes Afterpay payments.

- Stick to your budget to prevent financial strain.

Evaluating Benefits and Downsides

Sticking to a budget ensures you don’t overextend yourself financially, but it also means you might not be able to make every purchase you want through Afterpay.

Prioritizing Essential Purchases

Prioritizing your spending on essential items can ensure you use your Afterpay limit responsibly.

Needs over Wants

- Make a list of essential purchases before considering discretionary spending.

- Use Afterpay for these essential items, thus managing your available credit better.

Evaluating Benefits and Downsides

This prioritization can help maintain financial stability but may limit impulse buys or leisure shopping.

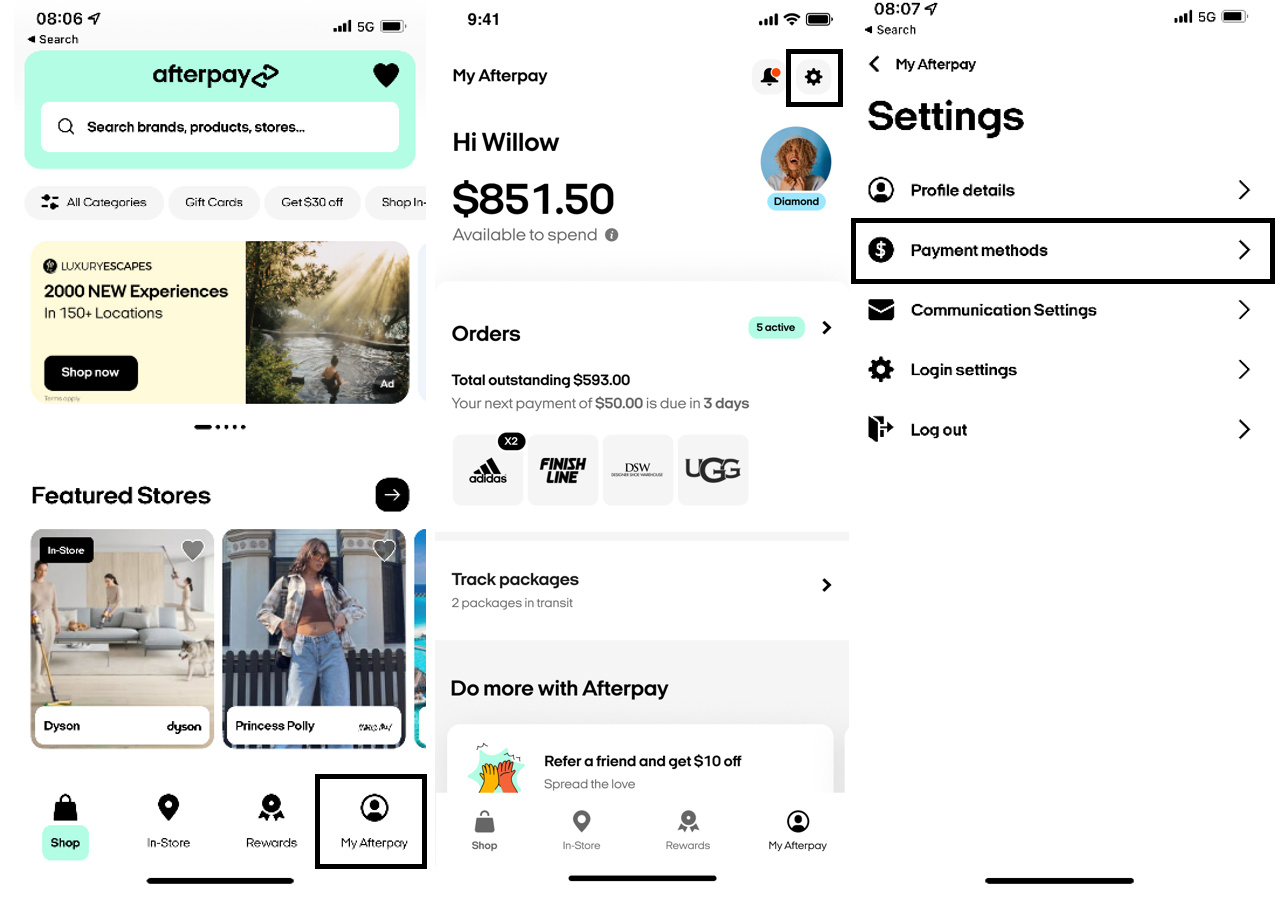

Leveraging the Afterpay App

Using the app might provide a more intuitive and immediate way to manage your orders.

App Usage

- Download the Afterpay app from your respective app store.

- Use the app to keep track of due payments and remaining balance in real-time.

Evaluating Benefits and Downsides

The app offers convenience and up-to-date order tracking, but it requires you to be comfortable with using mobile applications for financial transactions.

Learning from the Afterpay Community

Join online forums and social media groups where other Afterpay users share experiences and tips.

Community Engagement

- Search for Afterpay-related forums or Facebook groups.

- Engage with the community by asking questions and reading through others’ experiences.

Evaluating Benefits and Downsides

Being a part of Afterpay’s user community can provide real-world insights, though the advice received may not apply universally due to individual differences in account standing.

Solidifying Your Understanding

Revisit the details in this guide regularly as Afterpay’s policies and your personal financial circumstances may evolve.

Consistent Review

- Keep this guide handy for periodic review.

- Note any changes in Afterpay’s user guidelines or in your own financial situation.

Evaluating Benefits and Downsides

Staying informed ensures you can adapt to any changes, but requires ongoing effort to keep up to date with both Afterpay’s platform and your personal finances.

Navigating Your Afterpay Journey

Having explored various facets of managing Afterpay orders, it’s clear that while Afterpay sets limits to encourage responsible spending, these limits are flexible and can change over time based on your individual usage and history with the service. By paying on time, monitoring your spending, and using tools and resources provided by Afterpay, you can increase your chances of having the ability to place multiple orders simultaneously. Remember, the key is to stay informed and spend within your means, ensuring an enjoyable and stress-free shopping experience.

In conclusion, Afterpay’s flexibility can be a powerful tool for managing your finances, but it also requires a strong commitment to responsibility and a good understanding of your personal spending limits. Regularly reviewing your account and staying engaged with the Afterpay community can help maximize the benefits of this payment service while minimizing potential drawbacks.

FAQs

-

Can everyone have the same number of Afterpay orders at the same time?

Every Afterpay user has a different limit based on factors like payment history and time with the service. This means not everyone will have the same number of simultaneous orders they can place. -

Does paying off purchases early increase my Afterpay order limit?

Although Afterpay hasn’t explicitly stated this, regularly paying on time or early could positively impact your account standing and potentially your order limit. -

What happens if I reach my Afterpay order limit?

If you reach your limit, Afterpay may decline your attempts to place new orders until some of your existing balances are paid off.