Managing a business successfully requires a strong grasp of your finances. Understanding how long your organization can operate with the cash it has on hand is crucial. The measurement of this financial security is known as “days cash on hand.” This metric will help you gain insight into how well your company can handle unexpected financial challenges or take advantage of new opportunities without immediate additional income.

Understanding Days Cash on Hand

Before diving into calculations, it’s important to understand what days cash on hand means for a business. Simply put, this financial metric indicates how many days your company could continue to pay its expenses, using only the cash it has available, without relying on additional income or financing. It is a powerful indicator of a company’s liquidity and short-term financial health.

Detailed steps:

-

Gather Financial Statements: You need your most recent balance sheet and income statement. These documents contain the necessary numbers to calculate your cash levels and average daily operating expenses.

-

Identify Total Cash: On your balance sheet, locate the total cash and cash equivalents. This may include your business bank account balances, petty cash, and marketable securities or other liquid assets that can quickly be converted to cash.

-

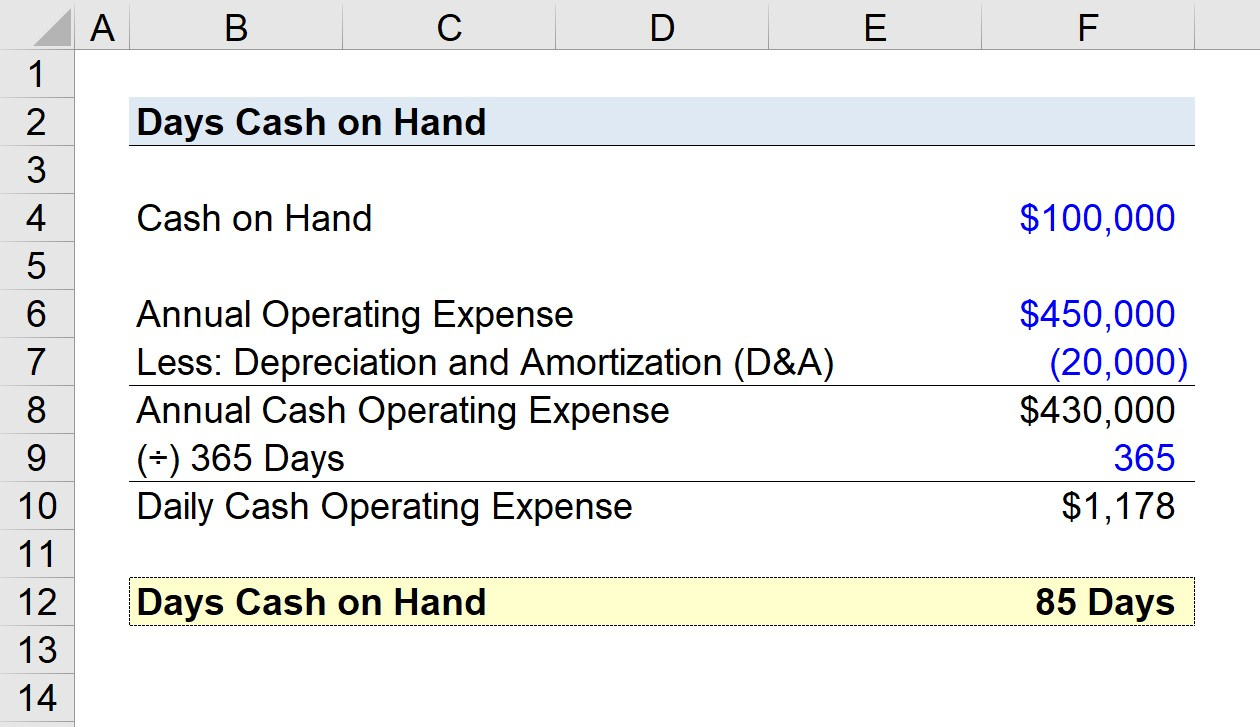

Calculate Average Daily Operating Expenses: Using your income statement, add up all your operating expenses for the year, and divide by 365 days to obtain the average daily operating expense.

-

Divide Total Cash by Daily Expenses: With your total cash and average daily expenses determined, divide your total cash by the daily operating expenses to find out how many days your company could operate solely on its current cash.

Summary:

Calculating days cash on hand provides a clear picture of your company’s ability to sustain operations during slow periods without additional income. It’s a great tool for financial planning, helping to ensure that you maintain enough liquidity to cover costs and emergencies. However, overestimating cash or failing to account for all operational costs could result in a less accurate calculation.

Utilizing Financial Ratios

In addition to understanding your cash on hand, it’s beneficial to become familiar with financial ratios that can offer deeper insights into your company’s fiscal health.

Detailed steps:

-

Learn Financial Ratios: Research key financial ratios like the current ratio, quick ratio, and operating cash flow ratio.

-

Apply Ratios to Your Business: Use your financial statements to calculate these ratios for your business.

-

Interpret the Results: Analyze the ratios to understand your company’s liquidity, efficiency, and profitability.

Summary:

Using financial ratios along with days cash on hand can give you a better sense of your company’s financial health. They enable more strategic decision-making but require an understanding of accounting principles and how these ratios interconnect with your business’s specific circumstances.

Tips for Managing Cash Flow

Proper cash management is essential to ensure that your cash on hand lasts as long as you need it to.

Detailed steps:

-

Monitor Your Cash Flow: Keep a close eye on your cash flow statement to understand the cash moving in and out of your business.

-

Reduce Costs Where Possible: Look for opportunities to decrease unnecessary expenses.

-

Improve Receivables: Accelerate the inflow of cash from customers by using strategies like early payment discounts or penalties for late payment.

Summary:

Effective cash flow management can extend your days cash on hand by reducing costs and improving cash inflow. However, be cautious not to sacrifice long-term growth for short-term liquidity.

Setting Up Emergency Reserves

Establishing an emergency cash reserve can safeguard your business against unexpected financial difficulties.

Detailed steps:

-

Determine Reserve Size: Decide how many months of operating expenses you want to cover with your reserve.

-

Create a Savings Plan: Set aside a fixed percentage of monthly revenue to build up your reserve.

-

Keep Reserves Accessible: Store your emergency fund in a liquid account where you can access it without delay.

Summary:

An emergency reserve can act as a buffer, but it must be sized appropriately and replenished as necessary. It is not a substitute for revenue but rather a part of a comprehensive risk management strategy.

Budgeting for Financial Health

A well-planned budget helps to manage and predict cash flow, ensuring you maintain adequate days cash on hand.

Detailed steps:

-

Develop a Budget: Create a budget based on historical financial data and projected revenue and expenses.

-

Track Actuals: Regularly compare actual financial results to your budget to spot variances early.

-

Adjust as Necessary: Revise your budget in response to significant changes in your business environment.

Summary:

While budgeting is a proactive approach to maintaining your days cash on hand, it can also be time-consuming. The benefits often outweigh the effort, as it can prevent cash shortages and keep your business running smoothly.

Projecting Future Cash

Anticipating future cash levels helps with long-term planning and can impact your days cash on hand.

Detailed steps:

-

Forecast Revenues and Expenses: Use past trends to project future cash flows.

-

Incorporate Seasonality: Account for seasonal variations in your business that affect cash flow.

-

Update Projections Regularly: Make it a habit to regularly update your cash flow projections to maintain accuracy.

Summary:

This proactive step helps in anticipating cash needs and challenges but requires accurate and current financial data to be effective.

Negotiating with Suppliers

Building strong relationships with suppliers can lead to better payment terms, affecting your cash on hand.

Detailed steps:

-

Communicate with Suppliers: Have open discussions about payment terms that could benefit both parties.

-

Seek Mutually Beneficial Arrangements: Negotiate terms such as extended payment periods or bulk purchase discounts.

-

Maintain Good Standing: Pay on time to foster trust and goodwill.

Summary:

Negotiating with suppliers can free up cash, but take care to maintain positive relationships and not to hinder operational needs.

Optimizing Inventory Management

Effective inventory management ensures you’re not tying up unnecessary cash in stock.

Detailed steps:

-

Analyze Inventory Levels: Regularly review inventory to identify excess or slow-moving stock.

-

Implement Just-In-Time Inventory: Arrange for inventory to arrive as it is needed, thereby reducing carrying costs.

-

Use Inventory Management Software: Invest in software to better track and manage inventory levels.

Summary:

Optimizing inventory can improve cash positions but requires a balance to avoid stockouts that could disrupt business.

As your business continues to grow and evolve, managing your resources effectively becomes increasingly important. Calculating days cash on hand is a fundamental part of this management process, allowing you to maintain financial flexibility and resilience in the face of unpredictable economic conditions and industry-specific challenges. By following the detailed steps and considering the additional tips and strategies given, you can stay ahead in maintaining the financial stability of your enterprise.

Conclusion:

Understanding and calculating days cash on hand is a vital skill for any business owner or financial manager. It’s a cornerstone of sound financial planning, giving you the confidence to navigate the ups and downs of business cycles. The tips and solutions provided here will help you make informed decisions to secure the financial health of your organization well into the future.

FAQs:

Q1. Why is days cash on hand important for a business?

A1. Days cash on hand is critical as it measures a company’s liquidity and ability to cover expenses without relying on additional income, which is essential during downturns or unforeseen events.

Q2. How can improving receivables affect days cash on hand?

A2. Improving receivables accelerates cash inflow, increasing the available cash, which can extend the number of days a company can operate without additional income.

Q3. Can a company have too much cash on hand?

A3. Although having cash is generally positive, excessive cash may indicate that the company is not effectively utilizing its resources to grow or invest, which could be a missed opportunity.