When considering an extended warranty for your electronics, appliances, or car, it’s important to weigh the potential costs and benefits. An extended warranty might offer peace of mind by covering repairs after the standard warranty expires, but it comes with an added expense. Carefully calculating the cost of an extended warranty will help you make an informed decision about whether it’s a worthwhile investment for you.

Manufacturer’s Extended Warranty

When a product’s standard warranty is about to expire, manufacturers often offer their own extended warranties. This type of warranty can be more expensive but may offer more comprehensive coverage.

Detailed Steps:

- Review the Original Warranty: Understand what the original manufacturer’s warranty covers and for what time period.

- Check the Extended Warranty Details: Look for information about what the extended warranty covers that the original does not.

- Compare Coverage Length: Determine how much longer the product will be covered under the extended warranty.

- Evaluate Cost: Find out the price for the extended warranty and when it needs to be purchased.

- Consider Likelihood of Repairs: Research the reliability of the product to estimate potential future repair costs.

- Factor in Deductibles and Service Fees: Some extended warranties include deductibles or service fees for repairs.

Summary:

A manufacturer’s extended warranty usually aligns seamlessly with the product but it might cost more than third-party options. It’s beneficial for keeping repairs consistent with the product’s brand, though often at a premium cost.

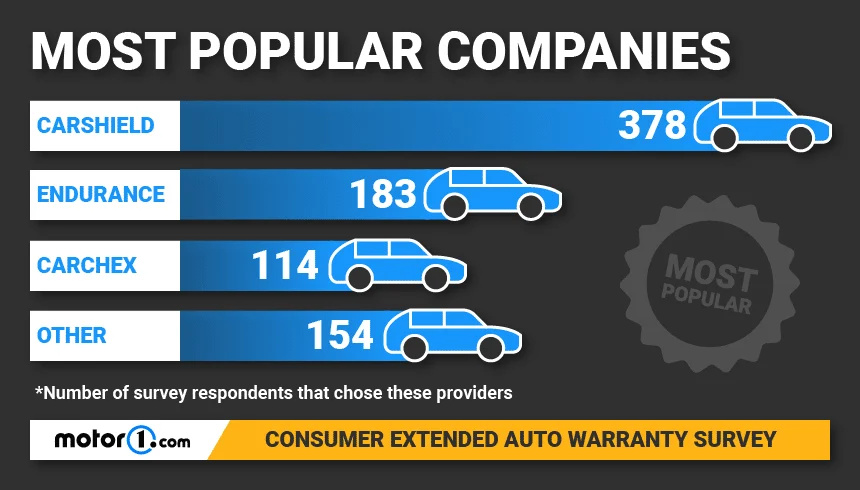

Third-Party Warranty Providers

These providers offer extended warranties that can be less expensive and more flexible but may come with some trade-offs in terms of service and coverage.

Detailed Steps:

- Research Providers: Look for reputable third-party warranty companies.

- Compare Plans: Evaluate different plans for what they cover, their limitations, and exclusions.

- Check Compatibility: Ensure the warranty covers the brand and model of your product.

- Assess Costs and Payment Plans: Determine the price and payment options available.

- Read Customer Reviews: Look at other customers’ experiences with the provider.

- Understand the Claims Process: Know how to file a claim and what the response times are.

Summary:

Third-party warranties may be more affordable and flexible. However, they may not offer the same level of cover or customer service as a manufacturer’s warranty.

Cost-Benefit Analysis

A cost-benefit analysis involves calculating the expected costs of repairs and comparing them to the cost of the warranty.

Detailed Steps:

- Estimate Repair Costs: Research average repair costs for the item in question.

- Estimate Likelihood of Repairs: Based on the product’s reliability data, estimate how likely it is you will need repairs.

- Calculate the Warranty Cost: Add up the total cost of the extended warranty over the coverage period.

- Compare Costs: Weigh the total potential repair costs against the warranty cost.

Summary:

Performing a cost-benefit analysis can show whether the extended warranty is likely to save you money. The downside is it requires more effort to research the necessary data.

Length of Coverage

The time frame that an extended warranty covers can influence its value.

Detailed Steps:

- Review Warranty Terms: Identify how many additional years or months the warranty adds.

- Match With Product Lifespan: Compare this with the average lifespan of the product.

- Assess Product Usage: Consider how heavily the product will be used and whether this will affect its longevity.

Summary:

Opting for coverage that matches your expected use ensures you don’t pay for unnecessary extra time, although it might be challenging to predict future product usage accurately.

Coverage Limits

Understanding the limitations and caps of a warranty’s coverage is key to evaluating its true cost.

Detailed Steps:

- Review Coverage Caps: Look for any maximum repair costs that the warranty will cover.

- Identify Exclusions: Understand what types of damage or repairs are not covered.

- Clarify Repair or Replacement Policies: Know whether the warranty covers a full replacement or only repairs.

Summary:

Recognizing coverage limits is crucial; not understanding them could lead to unexpected out-of-pocket expenses if a claim exceeds those limits.

Deductibles and Fees

Some warranties include additional costs like deductibles or service fees that could affect the overall value.

Detailed Steps:

- Find Deductible Amounts: Look for any fixed costs you must pay when a repair is needed.

- Understand Service Fees: Identify if there are charges for service visits or support calls.

- Calculate Total Potential Costs: Include these additional fees when assessing the warranty’s cost.

Summary:

While deductibles and fees can make a warranty seem less expensive upfront, they can lead to higher costs over time.

Transferability

The ability to transfer a warranty to a new owner can increase its value, especially for products like cars.

Detailed Steps:

- Check Transfer Policy: Determine if and how the warranty can be transferred.

- Understand Transfer Costs: Look for any fees associated with transferring the warranty.

- Consider Future Sale: Assess whether you plan to sell the item before the warranty expires.

Summary:

Transferable warranties might add value to your item if you sell it, but be aware of any transfer costs that may apply.

Inflation and Future Pricing

Accounting for future changes in repair costs due to inflation can affect the overall cost-benefit of an extended warranty.

Detailed Steps:

- Learn About Fixed Prices: Check if the warranty guarantees price protection against inflation.

- Estimate Inflation Rates: Consider potential increases in repair costs over time.

- Compare with Warranty Cost: Factor in inflation when comparing repair costs to the warranty price.

Summary:

Inflation protection can be a significant advantage of an extended warranty, but this requires an understanding of economic trends.

Customer Service and Reputation

The level of customer service provided by the warranty provider is crucial in times of need.

Detailed Steps:

- Research Company Reputation: Look up customer reviews and ratings of the warranty provider.

- Test Customer Service: Try contacting their support to gauge response times and helpfulness.

- Review Resolution Times: Find out how quickly claims are typically resolved.

Summary:

Good customer service can greatly enhance the value of a warranty. However, excellent service may come at a higher price.

Claim Process Complexity

A complicated claim process can detract from an extended warranty’s value.

Detailed Steps:

- Understand Claim Filing: Familiarize yourself with the steps needed to file a claim.

- Gather Necessary Documentation: Know what documents are required to support a claim.

- Consider Hassle Factor: Reflect on whether the complexity of filing a claim is worth the potential benefits of the warranty.

Summary:

Easier claim processes increase the practicality of a warranty, but navigating complex procedures can be a significant drawback.

Special Offers and Discounts

Sometimes, providers offer discounts or special offers on extended warranties that can influence the overall cost.

Detailed Steps:

- Look for Promotions: Keep an eye on any available discounts or promotional rates.

- Calculate Adjusted Prices: Apply these discounts to see the new cost of the warranty.

- Beware Expiration: Note if and when these offers expire to avoid missing out.

Summary:

Special offers can significantly reduce the upfront cost of a warranty, but ensure the quality and terms of coverage aren’t compromised.

Making the decision to purchase an extended warranty can have long-term financial implications. Therefore, it’s essential to carefully assess the cost of an extended warranty in the context of the value it provides. With the considerations outlined here, you’ll have a framework for performing a thorough and informed analysis to decide if an extended warranty is a sound investment for you.

Frequently Asked Questions (FAQs):

-

Can I purchase an extended warranty after the manufacturer’s warranty has expired?

It depends on the product and the provider. Some allow it within a grace period after expiry, while others may require the extended warranty to be bought before the original warranty concludes. -

Does an extended warranty cover accidental damage?

Most extended warranties do not cover accidental damage unless specifically stated. It’s important to read the terms and conditions carefully to understand what is included. -

Is an extended warranty refundable?

Policies vary by provider. Some extended warranties may offer a prorated refund if canceled before it’s used, while others might be non-refundable. Check with the provider for specific terms.