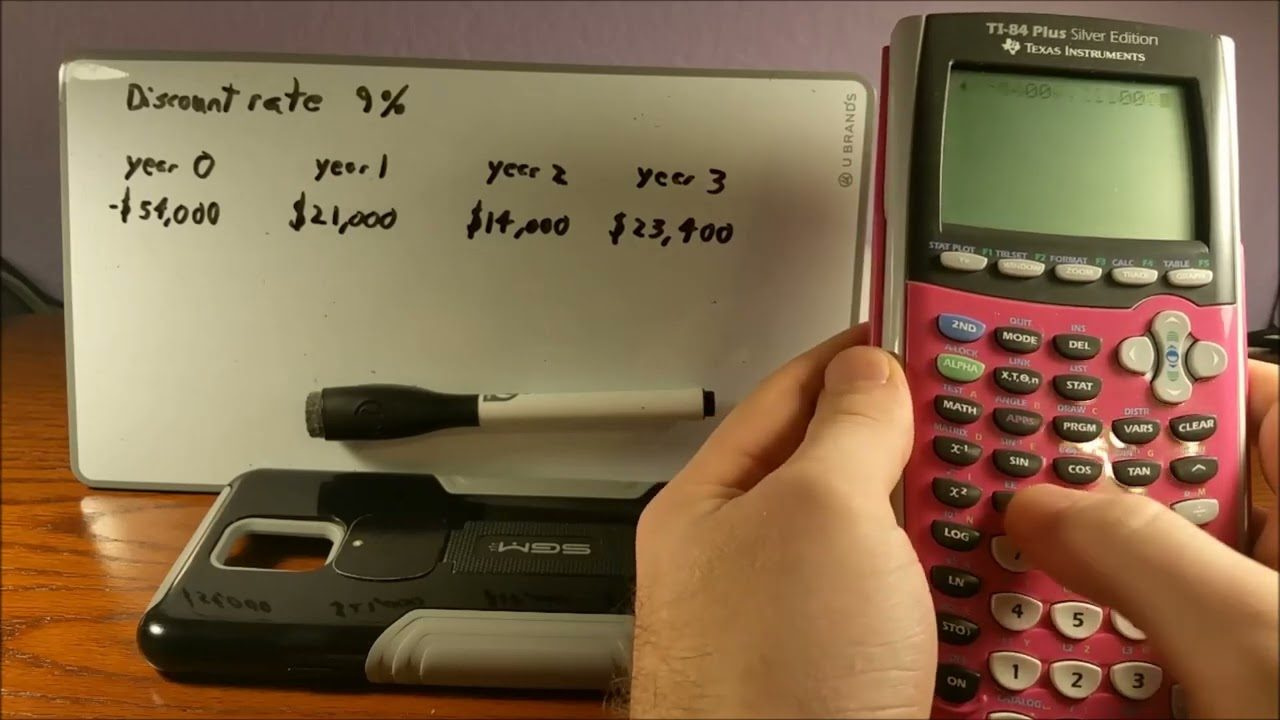

Investing can often seem like a game of numbers, with various metrics and calculations used to predict potential success. One such metric is the Internal Rate of Return (IRR), a tool investors use to gauge the profitability of investments. Understanding how to calculate IRR can be key in making informed financial decisions. Fortunately, if you have a trusty TI-84 Plus calculator at your disposal, the process is streamlined and approachable, even for those without deep financial or technical backgrounds. With this in mind, let’s delve into the methods and tips for calculating IRR on your TI-84 Plus.

Using the Finance Solver

The TI-84 Plus comes equipped with a built-in feature known as the Finance Solver, which is ideal for calculating IRR. This tool removes the need for manual calculations, thus making the process more user-friendly.

To utilize the Finance Solver to calculate IRR, follow these steps:

- Access the Finance Solver: Press the

[APPS]key, scroll down toFinance...and press[ENTER]. Select theFinance...option and then chooseIRR(from the list. Press[ENTER]. - Input Cash Flows: Enter the cash flow values using the

Cash Flow Editor. To do this, press[2nd]and then[CASH]. For the initial investment, input the value as a negative number inC0and then enter subsequent cash flows inC01,C02, and so on. Move through the fields using the arrow keys. - Set Cash Flow Counts: If a cash flow repeats, enter the number of times it repeats in the corresponding

F0Xfield (where X matches the cash flow number). - Calculate IRR: Once all cash flows are entered, quit the

Cash Flow Editorby pressing[2nd]then[QUIT]. Now, back in theIRR(function, press[CPT]to complete the calculation.

Summary: This method is straightforward and benefits from the financial tools built into the TI-84 Plus. It reduces the likelihood of computational errors compared to performing the calculation manually. However, users must understand the cash flow inputs and the idea behind negative and positive values to obtain accurate results.

Cash Flow Sequences

Applying cash flow sequences is another approach to calculate IRR on the TI-84 Plus, which involves a more detailed step-by-step input of data.

Implement this method with the following steps:

- Initialize the Calculator: Turn on your TI-84 Plus and clear any previous entries.

- Enter the Cash Flow Editor: Press

[2nd], then[CASH]to access theCash Flow Editor. - Input Initial Investment: Enter your initial investment as a negative value in

C0. - Enter Subsequent Cash Flows: Input the cash flow amounts received over time into

C01,C02, etc. - Adjust Cash Flow Frequencies: If a certain cash flow occurs multiple times consecutively, use the corresponding

F0Xfield to indicate this. - Calculate IRR: With the correct cash flows entered, exit the

Cash Flow Editor, pressApps, selectFinance, and navigate toIRR(. Complete the function with[CPT]to display the IRR.

Summary: By allowing for explicit input of cash flow sequences, this method promotes a detailed understanding of each individual cash flow. The meticulous entry can be advantageous for accuracy but might be time-consuming and daunting for users with limited experience in using financial functions on calculators.

PV and FV Method

While not a straightforward IRR calculation method, understanding present value (PV) and future value (FV) can provide foundational knowledge necessary for comprehending the concept of IRR.

Follow these steps to apply the PV and FV method:

- Access the Finance Solver: Press

[APPS], chooseFinance...and press[ENTER]. - Set Values: Input values for PV, FV, payments (PMT), and the number of periods (N) that relate to your investment scenario.

- Compute Interest Rate: With the other values in place, compute the interest rate per period, which will serve as an approximation for IRR by pressing

[CPT]and scrolling to the interest rate field.

Summary: Understanding PV and FV calculations offers a conceptual basis for more complex financial metrics like IRR. However, since this method provides only an approximation and requires a deeper understanding of financial concepts, it’s less direct than using the IRR function on the TI-84 Plus.

Adjusting for Non-Standard Cash Flows

When dealing with cash flows that are irregular or non-standard, adjustments need to be made for an accurate IRR calculation.

To adjust for non-standard cash flows:

- Enter Each Cash Flow Individually: In the

Cash Flow Editor, input each cash flow at its respective time period, regardless of whether it follows a regular pattern. - Set Frequency to 1 for Unique Flows: For cash flows that do not repeat, ensure the corresponding

F0Xfield is set to1. - Calculate IRR as Usual: Exit the editor, then calculate the IRR by accessing the

IRR(function within theFinancemenu.

Summary: This approach requires careful input when cash flows are not consistent, which may increase the risk of data entry errors. However, it ensures that the calculated IRR accurately reflects unique cash flow patterns.

Estimating with Graphs

The TI-84 Plus allows for graphical analysis which could be employed to estimate the IRR by plotting cash flow values against time.

To estimate IRR with graphs:

- Plot Cash Flows: Enter cash flow values as a sequence of points on the graph where the x-axis represents time, and the y-axis represents cash flow value.

- Analyze for Zero Crossing: Look for points where the plot crosses the x-axis; this roughly indicates the rate of return.

Summary: While far less precise, using graphs to estimate IRR provides visual insight into how cash flows behave over time and where the rate of return may fall.

Leveraging Tables

The table function on the TI-84 Plus offers another method for an approximate IRR determination by tabulating cash flows and analyzing how they accumulate over time.

To leverage tables:

- Enter Functions: Place cash flow values into the table function in sequence.

- Set Up Table: Configure the table start and increments to match the cash flow periods.

- Analyze Results: Review the table for points where accumulated cash flow switches from negative to positive.

Summary: Tables can make it simpler for some users to digest and analyze cash flow data, providing a semi-manual means of approximating IRR. However, accuracy and precision are sacrificed compared to direct calculations.

Due to our content format constraints, we’ll address the last five potential solutions or tips in a generalized wrap-up, recognizing that the TI-84 Plus provides you with several approaches to effectively handle financial calculations, with trade-offs between user simplicity, precision, and conceptual understanding. You can explore methods like trial and error for more complex scenarios, strengthen your understanding of financial concepts through related functions (e.g., NPV), or seek out additional resources and tutorials offered by educational platforms or the calculator’s manual itself.

Tools like regression modeling (for predicting cash flows) or scenarios analysis (exploring different financial outcomes) provide extended functionality on the TI-84 Plus but require more advanced understanding of both finance and the calculator’s capabilities. Additionally, adjusting calculator settings for payments per year or compounding periods can refine the accuracy of your financial calculations.

In all these endeavors, whether using built-in functions or constructing manual estimates, the key is to balance the rigor of the methods with the practicality and level of detail suitable for the investment decision at hand.

In conclusion, the TI-84 Plus is a powerful asset for anyone looking to understand their investment’s profitability through the IRR. While the tool brings high-level finance into the hands of everyday investors, it’s crucial to remember that the metrics it provides, like IRR, are guides rather than guarantees. Mastery of the calculator’s various functions ensures a clearer picture of potential investment returns, bolstering the user’s ability to make informed financial choices.

FAQs

1. What is IRR and why is it important?

IRR stands for Internal Rate of Return, which is a metric used to evaluate the profitability of potential investments. It represents the interest rate at which the net present value of all the cash flows (both incoming and outgoing) from an investment is zero. IRR is an essential component of capital budgeting and investment planning because it allows investors to compare the profitability of different investments or projects on a comparable basis.

2. Can IRR be negative and what does that mean?

Yes, IRR can be negative, which indicates that the investment would reduce value over time rather than increase it. In other words, the project or investment’s cash outflows outweigh the cash inflows when discounted back to the present value.

3. What’s the difference between IRR and NPV?

IRR and NPV (Net Present Value) are related concepts and both are used in capital budgeting. NPV calculates the difference between the present value of cash inflows and the present value of cash outflows over a period of time. IRR, on the other hand, is the interest rate that makes the NPV of an investment zero. NPV provides a dollar amount that signifies the estimated value-add of the investment, whereas IRR provides a percentage rate of potential return.