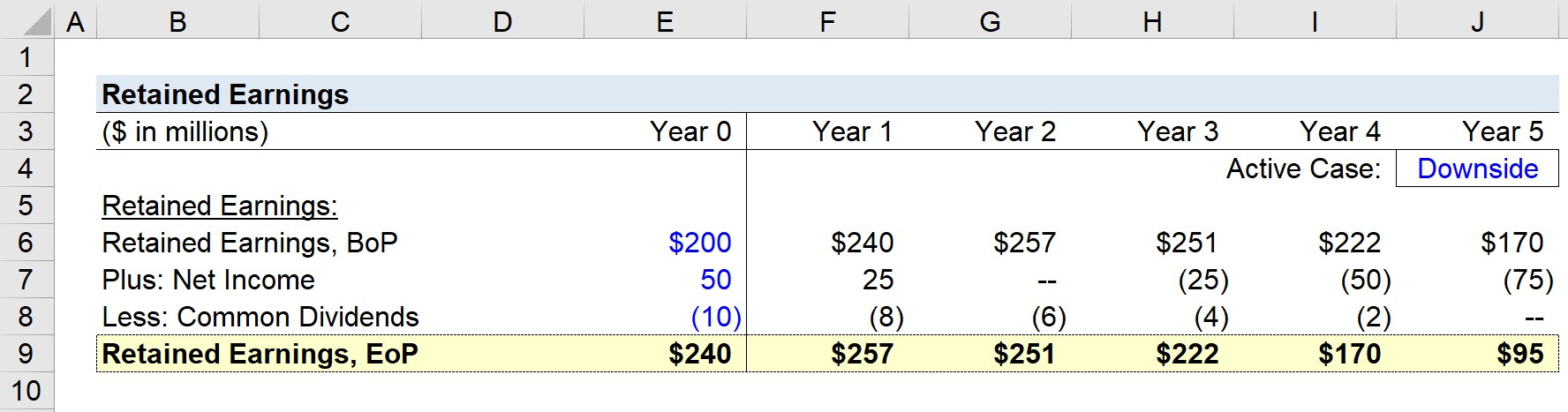

Understanding the financial health of a business is crucial for both its management and stakeholders. One key indicator of a company’s profitability over time is its retained earnings, which reflect the cumulative amount of net income that has been reinvested in the business, rather than distributed to shareholders as dividends. Calculating the addition to retained earnings involves a simple yet rewarding exercise in basic accounting. This process ensures that you have a clear picture of the profits that serve as a source for business growth and stability. This guide will walk you through the essential steps to accurately determine the increase in retained earnings within a given period.

Understanding Retained Earnings

Before diving into the calculations, it’s important to comprehend what retained earnings embody within a company’s financial structure. They represent the portion of net income that remains after dividends have been paid out to shareholders. Over time, this cumulative amount becomes a crucial component of shareholder equity in the balance sheet, signifying reinvestment in the company itself.

Steps:

-

Start with the Previous Period’s Retained Earnings: Begin by locating the retained earnings value from the end of the last accounting period. This information can be found on the balance sheet in the equity section.

-

Identify Net Income or Loss: Find the net income (or loss) for the current period from the income statement. This shows the company’s profitability after all expenses have been subtracted from total revenue.

-

Adjust for Dividends: Determine any dividends that the company has declared and distributed to shareholders during the current period. Dividends can be found in the shareholders’ equity statement or in the notes to the financial statements.

-

Calculate the Addition to Retained Earnings: Add the net income to the previous period’s retained earnings, then subtract any dividends paid out. The resulting figure is the addition to retained earnings for the current period.

Summary:

Calculating the addition to retained earnings helps track how much of the profits are being reinvested in the company, which is key for long-term growth. The principal downside is that it doesn’t provide insight into how effectively these reinvested earnings are being utilized within the business.

Reviewing Financial Statements

To calculate retained earnings accurately, one must diligently review the company’s financial statements—namely the balance sheet and the income statement. These documents offer the raw data needed for your computation: previous retained earnings, net income, and any dividends declared.

Steps:

-

Obtain Financial Statements: Gather the company’s most recent balance sheet and income statement, ensuring that they cover the relevant period for your calculation.

-

Analyze the Income Statement: Review the income statement to assure comprehension of the revenues, costs, expenses, and final net income.

-

Examine the Balance Sheet: Study the balance sheet to understand where the company stands with its assets, liabilities, and equity, focusing especially on the equity section where retained earnings are reported.

Summary:

Careful examination of financial statements allows for an accurate determination of additions to retained earnings. However, if these statements are not up-to-date or accurately maintained, miscalculations can occur.

Accounting Software Utilization

Modern businesses often use accounting software to automate financial tracking, including the calculation of retained earnings. These programs reduce manual errors and save time.

Steps:

-

Choose Suitable Accounting Software: Pick a reliable accounting software that aligns with your company’s size and complexity.

-

Enter Financial Data: Regularly input all financial transactions, including income, expenses, and dividends, into the software.

-

Generate Reports: Use the software to generate an updated balance sheet and income statement, which will automatically display the current retained earnings.

-

Review the Calculations: While the software handles the calculations, it’s essential to review them periodically to ensure accuracy.

Summary:

Accounting software significantly streamlines financial management, providing prompt and accurate calculations of retained earnings. However, the software is only as good as the data inputted, and users must understand the basics of financial reporting to ensure the information is accurate.

Regular Reconciliation

Regular reconciliation—verifying that the reported amounts match the actual accounts—is pivotal to maintaining accurate financial records, including additions to retained earnings.

Steps:

-

Choose a Regular Schedule: Set a consistent schedule (monthly, quarterly, annually) for reconciliation processes.

-

Compare Internal Records: Match internal transaction records with bank statements and other financial records to confirm accuracy.

-

Adjust for Discrepancies: When discrepancies arise, investigate and correct them to ensure that financial statements accurately reflect the company’s financial position.

Summary:

Consistent reconciliation guards against errors and fraud, ensuring reliable retained earnings calculations. However, it requires a systematic approach and diligent record-keeping.

Dividend Policy Tracking

Understanding and keeping track of the company’s dividend policy is essential because dividends directly affect retained earnings.

Steps:

-

Study the Dividend Policy: Review company policies to understand the frequency and method used for dividend payments.

-

Monitor Dividend Declarations: Keep an eye on board meeting minutes or official announcements for information on declared dividends.

-

Record Dividend Payments: Document all dividend payments as they occur to ensure they are accurately reflected in the retained earnings calculation.

Summary:

Effective management of dividend policies and payments is crucial in the evaluation of retained earnings. Neglecting to account for dividends can lead to significant errors.

Understanding Legal Reserves

In some jurisdictions, companies are required to set aside a portion of their profits into legal reserves. This impacts the calculation of retained earnings.

Steps:

-

Research Local Regulations: Understand the laws and regulations regarding mandatory reserve requirements in your company’s operating regions.

-

Calculate Mandatory Reserves: Determine the required reserve amount before calculating the final addition to retained earnings.

-

Adjust Retained Earnings Calculation: Ensure that the mandatory reserve is accounted for in the retained earnings equation, reducing the amount available for dividends or reinvestment.

Summary:

Accounting for legal reserves is a critical but often overlooked aspect of retained earnings calculation, providing a safety net for a company’s financial health, although it limits the amount available for immediate reinvestment.

Impact of Stock Transactions

Company stock transactions, such as buybacks or new issuances, can affect retained earnings.

Steps:

-

Track Stock Transactions: Maintain records of any stock buybacks or issuances as these will impact shareholders’ equity and retained earnings.

-

Calculate Impact on Retained Earnings: Understand how these transactions affect retained earnings and reflect them accurately in financial statements.

Summary:

Stock transactions can significantly influence retained earnings by altering company equity. It requires a fundamental understanding of corporate finance to manage these impacts effectively.

Financial Forecasting

Forecasting future additions to retained earnings is a proactive step that helps companies plan and make informed business decisions.

Steps:

-

Analyze Historical Data: Review past retained earnings trends for predictive insights.

-

Consider Current Factors: Include present economic conditions, company performance, and industry trends in your forecast.

-

Project Future Earnings: Use your analysis to forecast potential future additions to retained earnings.

Summary:

Although financial forecasting offers valuable planning insights, it’s speculative by nature and must be used cautiously, considering its uncertainties.

Assessing for Growth and Sustainability

Evaluating the sustainability of a company’s growth patterns in relation to its retained earnings can signal long-term viability.

Steps:

-

Examine Growth Metrics: Look at revenue growth, profit margins, and return on equity to assess sustainable growth.

-

Relate to Retained Earnings: Understand how retained earnings contribute to the funding of sustainable growth initiatives.

Summary:

The assessment of growth against retained earnings provides a broader context for company performance. However, growth solely funded by retained earnings may be unsustainable if not supported by additional funding sources.

Training and Education for Staff

Educating staff about the importance of accurate financial reporting, including retained earnings calculation, promotes company-wide financial literacy and accountability.

Steps:

-

Develop Training Programs: Create regular seminars or workshops to educate staff on financial concepts.

-

Promote Financial Literacy: Encourage an understanding of how individual roles impact the company’s finances and retained earnings.

Summary:

While staff training fosters informed decision-making and accurate reporting, it requires investment in resources and time for development and implementation.

Conclusion

Accurately calculating and understanding additions to retained earnings is not only beneficial for assessing a company’s past performance but also for planning its future. While each step excavates deeper into the technicalities of accounting, they collectively form a robust foundation for financial clarity—a key to any thriving business.

FAQs

What are retained earnings?

Retained earnings represent the total profits that a company has reinvested in itself after paying out dividends to shareholders.

How often should retained earnings be calculated?

Retained earnings should be calculated at the end of each reporting period, which can be monthly, quarterly, or annually.

Do retained earnings impact company value?

Yes, retained earnings reflect a company’s ability to generate profits and can be reinvested for growth, thus potentially increasing company value over time.