When an asset is sold or disposed of, it’s important to understand the financial implications this has on a business’s taxes. Calculating the after-tax salvage value is an essential part of this process. This value is what remains after the asset’s sale price is adjusted for the costs of removal, any remaining book value, and crucially, tax consequences. But how does one determine this figure without getting lost in a maze of numbers and tax laws? Fear not, this step-by-step guide is designed to walk you through the calculation, ensuring you understand each part of the process.

Understanding After-Tax Salvage Value

Before jumping into calculations, it’s important to grasp what after-tax salvage value really means. It’s the amount you expect to receive from disposing of an asset, after accounting for potential taxes on any gains from its sale and subtracting any disposal costs. This figure is essential for businesses as it impacts final investment decisions, and can affect tax liabilities.

Detailed Steps:

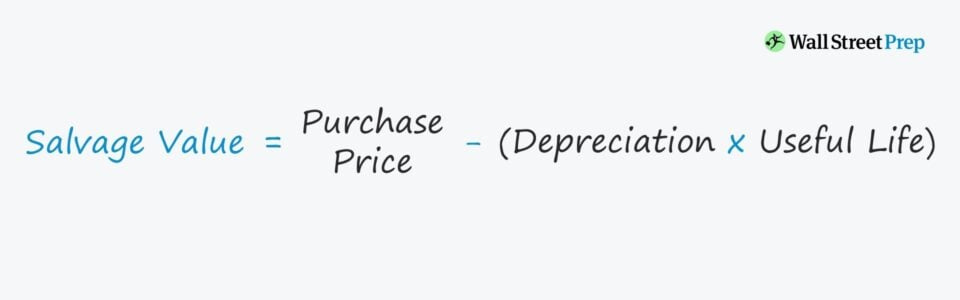

- Identify the salvage value: Determine the expected sale price of the asset at the end of its useful life.

- Calculate the book value: Subtract the accumulated depreciation from the original cost of the asset to find its book value.

- Determine the gains or losses: Compare the book value with the salvage value to establish if there’s a gain or a loss.

- Assess the tax rate: Find out the tax rate applicable to your capital gains or losses.

- Compute the tax effect: Multiply the gain or loss by the tax rate to get the tax effect.

- Subtract tax from salvage value: If there was a gain, subtract the tax effect from the salvage value to get the after-tax salvage value. If there was a loss, add the tax savings to the salvage value.

- Deduct any disposal costs: Subtract any costs associated with disposing of the asset.

- Arrive at the after-tax salvage value: The resulting figure is your after-tax salvage value.

Summary:

This approach ensures you account for all the variables involved in disposing of an asset. Its main benefit is the accurate reflection of net proceeds, vital for precise financial forecasting. A potential downside could be the complexity of tax laws, which might necessitate professional advice.

Considering Depreciation Methods

Different depreciation methods can significantly affect the calculation of the after-tax salvage value. Straight-line and accelerated depreciation methods, for instance, spread the asset’s cost differently over its useful life.

Detailed Steps:

- Choose a depreciation method: Straight-line, double-declining balance, or units of production are common.

- Apply the method: Calculate accumulated depreciation using the chosen method.

- Redo the book value calculation: Incorporate the new depreciation figure to determine an updated book value.

- Proceed with the initial steps: Follow the previous steps to find the after-tax salvage value using the new book value.

Summary:

Understanding depreciation’s impact on book value clarifies tax implications. However, choosing the wrong method might affect accuracy.

Evaluating Capital Gains Tax

Capital gains tax is a pivotal element in calculating after-tax salvage value when the asset’s sale price exceeds its book value.

Detailed Steps:

- Confirm the tax rate for capital gains: This can differ from ordinary income tax rates.

- Identify capital gains: Subtract the book value from the salvage value.

- Calculate the capital gains tax: Apply the rate to your gains.

- Adjust the salvage value: Deduct the capital gains tax from the salvage value.

Summary:

Considering capital gains tax ensures compliance and avoids unexpected tax liabilities, though it can be complex to navigate various tax rates.

Accounting for Loss Carryforward

If your asset’s disposal results in a loss, some tax systems allow you to carry this loss forward to offset future gains.

Detailed Steps:

- Understand loss carryforward: Research how it’s applied in your tax jurisdiction.

- Compute the loss amount: If the book value exceeds the salvage value, that’s your loss.

- Apply to future gains: Reduce future capital gains by this amount when the time comes.

- Revisit previous calculations: This factor might alter your after-tax salvage value in future periods.

Summary:

Loss carryforward can result in future tax savings but involves understanding tax regulations and planning.

Inflation Adjustment

Inflation can erode the real value of your expected salvage value over time.

Detailed Steps:

- Determine the inflation rate: Find the average anticipated rate for the asset’s remaining life.

- Apply to future value: Adjust the salvage value considering the inflation rate.

- Redo tax calculations: Use the adjusted salvage value when repeating earlier steps.

Summary:

Adjusting for inflation provides a more realistic picture of future value. However, predicting inflation rates is uncertain, which can add complexity.

Leveraging Salvage Value in Investment Decisions

Understanding after-tax salvage value is crucial in evaluating the profitability of an investment.

Detailed Steps:

- Incorporate into cash flow projections: Use the after-tax salvage value in investment analysis calculations.

- Reassess investment viability: The after-tax salvage value might influence the overall attractiveness of an investment.

Summary:

Incorporating after-tax salvage value into investment decisions can significantly affect profitability assessments, though it demands accurate calculation and foresight.

Considering Disposal Costs

Disposal costs can vary widely and must be factored into the after-tax salvage value.

Detailed Steps:

- Estimate disposal costs: Include transportation, legal fees, or environmental cleanup.

- Subtract from salvage value: Deduct these from the gross salvage value before taxes.

- Adjust calculations: Follow the tax calculation steps with this new figure.

Summary:

Accounting for disposal costs avoids underestimating expenses, though these costs may be difficult to predict.

Consulting Tax Professionals

Tax laws are complex and can have significant influences on the after-tax salvage value calculation.

Detailed Steps:

- Seek professional advice: Consider hiring a tax expert to ensure accuracy.

- Review tax planning strategies: A professional can help optimize your tax position regarding asset disposal.

Summary:

Consulting tax professionals ensures compliance and optimization, yet represents an additional cost.

Checking with Industry Standards

Industry practices around salvage value can guide your estimations.

Detailed Steps:

- Research industry norms: Look into how similar businesses estimate and handle salvage value.

- Adjust your practices: Tailor your calculations to align with these norms, if applicable.

Summary:

Adhering to industry standards can foster consistency and benchmarking but may not perfectly fit every unique situation.

Using Specialized Software

Tax calculation software can automate many of the complex tasks involved.

Detailed Steps:

- Select appropriate software: Choose one that’s widely respected and fits your business needs.

- Input data accurately: Ensure the information entered is correct for reliable output.

- Apply software outputs: Use the calculations provided by the software in your overall analysis.

Summary:

Software can expedite and simplify calculations, though it requires investment and data validation.

Regular Legal and Financial Updating

Tax laws and financial norms evolve, impacting how you calculate after-tax salvage value.

Detailed Steps:

- Stay informed: Regularly review changes in tax legislation and financial reporting standards.

- Revise calculations: Update your methods as required to reflect current requirements.

Summary:

Keeping abreast of changes ensures continued accuracy in your calculations, but demands ongoing vigilance and adaptation.

In conclusion, calculating the after-tax salvage value is a multi-step process that must capture several factors to ensure it accurately reflects the net value you can expect from disposing of an asset. While it involves an understanding of tax regulations and financial accounting, methodically working through each step can simplify this complexity. By considering things such as depreciation methods, capital gains tax, inflation, and seeking professional advice when needed, you can have a robust understanding of after-tax salvage value, aiding wise business and investment decisions.

FAQs

Q: Why is it important to calculate the after-tax salvage value?

A: The after-tax salvage value is crucial for accurate financial projections, tax reporting, and making informed decisions about asset investments and disposals.

Q: Can I carry forward a loss if the salvage value is less than the book value?

A: Depending on your tax jurisdiction, you may be able to carry forward a loss to offset against future capital gains. It’s always best to check with a tax professional for your specific situation.

Q: How often should I revise my after-tax salvage value calculations?

A: You should revise your calculations whenever there’s a significant change in tax laws, financial standards, or any other factor that could affect the asset’s value or the associated tax implications. Regular reviews at least annually are also recommended.