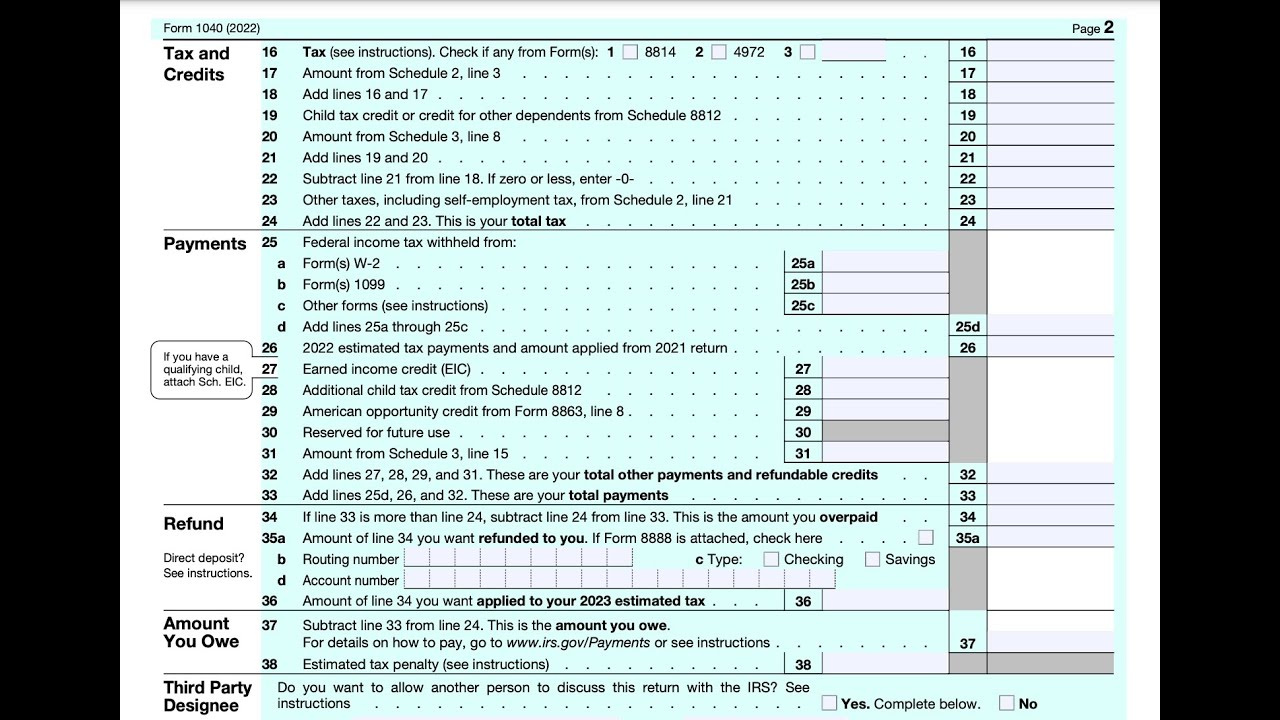

Tax time can be daunting, with a myriad of forms and lines to decode. One such line, Line 16 on IRS Form 1040, is integral to understanding your taxes. This line holds the key to reporting additional taxes owed, such as unreported tips or the alternative minimum tax. Navigating through the tax form, this guide aims to simplify the complexities and equip you with the confidence to calculate Line 16 accurately, ensuring a smoother tax filing experience.

Understanding Line 16

Before you tackle Line 16 on Form 1040, it’s essential to know its purpose. This line is where you report specific additional taxes, which may not apply to everyone. It includes taxes such as the Alternative Minimum Tax (AMT) and household employment taxes. Our focus here is to uncover when and how these taxes impact your return.

Identifying If You Owe Additional Taxes

- Review your income sources: Check if you have any income from sources like self-employment, which may be subject to additional taxes.

- Examine your previous year’s tax return: If you paid AMT or other additional taxes last year, consider whether similar situations apply to this year.

- Consider household employment taxes: If you employ someone in your home, you may owe employment taxes, commonly referred to as “nanny taxes.”

Calculating Alternative Minimum Tax (AMT)

- Gather all necessary documents: Collect your income statements, such as W-2s and 1099s, and documentation for deductions and credits.

- Complete IRS Form 6251: This form will help determine if you owe AMT by factoring in various adjustments to your income.

- Transfer the amount to Line 16: If you have a positive amount on Line 11 of Form 6251, this is your AMT, which you’ll report on Line 16 of Form 1040.

Summary: The AMT is designed to ensure that high-income earners pay a minimum amount of tax. Calculating it can be complex and may require professional assistance, but understanding it ensures you’re paying the correct tax amount.

Reporting Household Employment Taxes

Understanding and Assessing Household Employment Taxes

- Identify if you have a household employee: Determine if the person working in your home is an employee or an independent contractor.

- Calculate wages paid: Keep records of all wages paid throughout the tax year.

- Understand tax requirements: Know the thresholds that require tax payments and learn about Social Security, Medicare, and federal unemployment tax obligations.

Filing Schedule H

- Complete Schedule H: Fill out this form if you pay wages to a household employee.

- Attach to Form 1040: Schedule H should be attached to your personal tax return, Form 1040.

- Enter the amount on Line 16: Add the total taxes from Schedule H to the appropriate section of Line 16.

Summary: Reporting household employment taxes ensures you’re in compliance with tax obligations. Although it requires meticulous record-keeping and potentially additional paperwork, it protects both you and your employee.

Planning for Next Year

Analyzing Potential Additional Taxes

- Review changes in income: Changes in income levels can alter your additional tax liabilities.

- Adjust withholdings and estimates: To avoid surprises, adjust your tax withholdings or estimated payments throughout the year.

Summary: Being proactive with tax planning can significantly ease the burden when tax season arrives. Although it requires foresight, it can help avoid underpayment penalties and budgeting issues.

Conclusion

Tax calculation, especially the nuances of Line 16 on your Form 1040, can seem overwhelming. But with a step-by-step approach and a clear understanding of what’s required, you can navigate this part of your taxes with confidence. Remember, when in doubt, consult a tax professional to help guide you through the more intricate parts of the tax code.

FAQs

-

What is the Alternative Minimum Tax (AMT)?

The AMT is a separate tax calculation intended to ensure that certain taxpayers pay at least a minimum amount of tax. -

Who needs to fill out Schedule H for household employment taxes?

If you pay a household employee, such as a nanny or housekeeper, more than the threshold amount, you need to fill out Schedule H. -

Is it possible to owe additional taxes even if I had taxes withheld from my paycheck?

Yes, withholding taxes from your paycheck might not cover all your tax liabilities, especially if you have other income sources or owe specific additional taxes like the AMT or household employment taxes.