When making important financial decisions, understanding the potential profitability of an investment is crucial. The Net Present Value (NPV) is a core component of financial analysis, providing insight into the value of future cash flows in today’s terms. With the TI-84 Plus, a popular graphing calculator used by students and professionals alike, calculating NPV can be a straightforward process once you master the necessary steps. Our guide aims to demystify this process, turning the complex into the comprehensible, enabling you to evaluate your investments with confidence.

Calculating NPV Using the Finance Solver

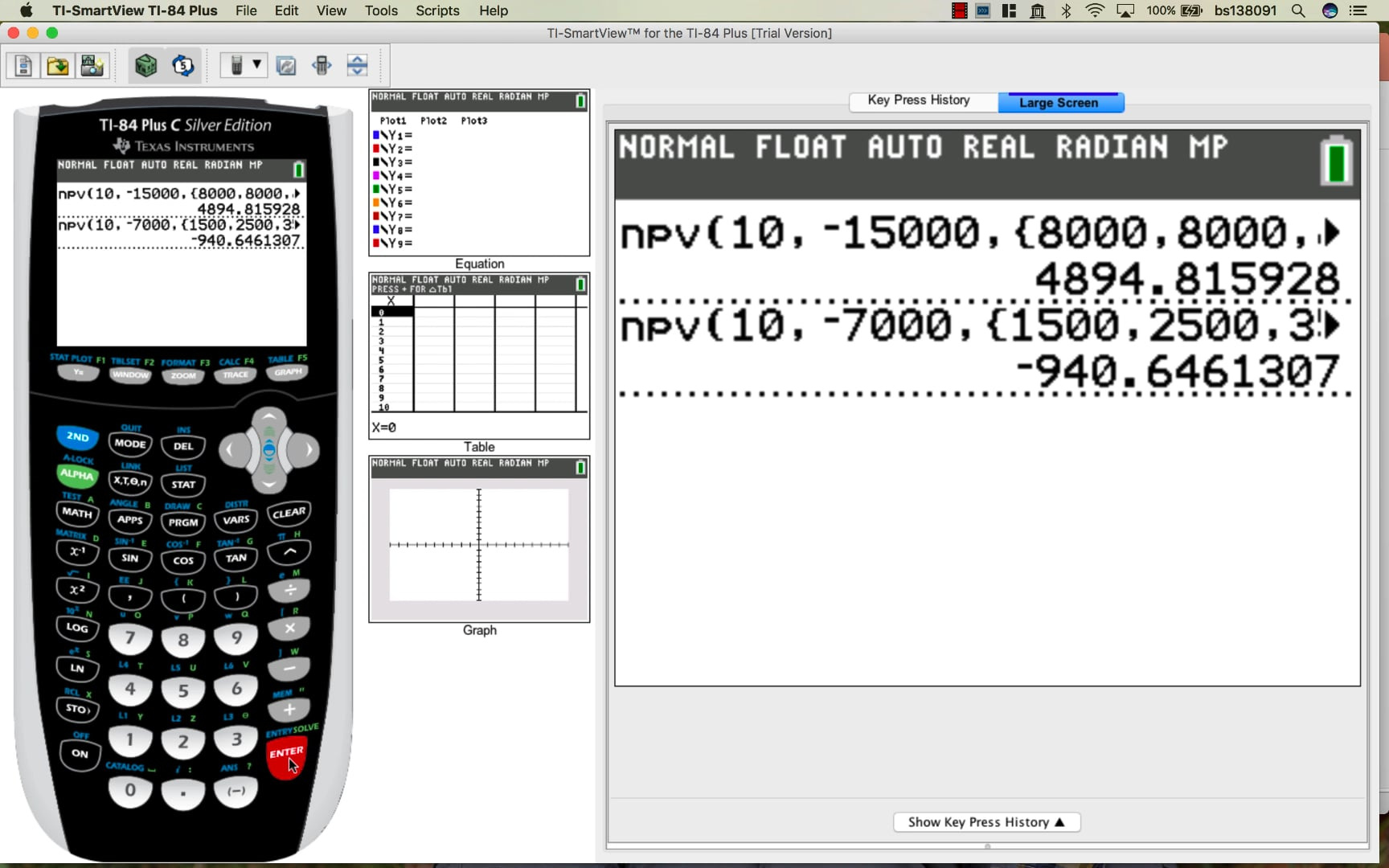

The TI-84 Plus comes with built-in finance functions, including a solver for NPV calculations. This approach is suitable for those who prefer direct computational methods.

-

Access the Finance Application

- Press the

APPSkey. - Scroll to the

Finance...app and pressENTER.

- Press the

-

Open the Finance Solver

- Scroll to

npv(and select it by pressingENTER.

- Scroll to

-

Enter the Interest Rate

- Type in the annual interest rate (as a percentage) without the percent sign. For instance, for a 5% rate, simply enter

5. - Navigate to the next line by pressing the

↓(down arrow) key.

- Type in the annual interest rate (as a percentage) without the percent sign. For instance, for a 5% rate, simply enter

-

Input Cash Flows

- Enter the initial investment as a negative value (since it’s an outflow), followed by the anticipated cash inflows for each period.

- Separate each cash flow with a comma.

-

Execute the Calculation

- Once all cash flows are entered, close the parentheses and press

ENTERto calculate the NPV.

- Once all cash flows are entered, close the parentheses and press

Summary: Using the Finance Solver is convenient and reduces the chance of input errors. However, it may not provide the flexibility needed for more complex cash flow structures.

Using the Cash Flow Function

TI-84 Plus also offers a Cash Flow function that lets you input individual cash flow amounts for each period.

-

Access Cash Flow Register

- Press the

APPSkey, chooseFinance...and then selectTVM Solver....

- Press the

-

Input Individual Cash Flows

- Enter each cash flow amount for the different periods as prompted.

-

Store Each Cash Flow

- After entering a cash flow, press the

ENTERkey to store it.

- After entering a cash flow, press the

-

Calculate NPV

- Input the discount rate and compute NPV by selecting the NPV function within the application.

Summary: The Cash Flow function accommodates discrete cash flow entries, providing precise control over the input. However, it may be more time-consuming for lengthy cash flow series.

Using a Spreadsheet Program

A spreadsheet program can simulate the TI-84 Plus’s NPV functionality. You can use this method to understand the mechanics before applying it on the calculator.

-

Create a Cash Flow Table

- Open a spreadsheet program and list the cash flows in one column.

-

Enter NPV Formula

- Input the NPV formula in a separate cell, referencing your cash flow cells and including the discount rate.

-

Analyze the Result

- Perform adjustments if necessary, and ensure understanding of the resulting calculation.

Summary: A spreadsheet can be a helpful learning tool with the flexibility of adjusting and observing different scenarios. However, it requires access to a computer and a basic knowledge of spreadsheet software.

Manual NPV Calculation

For those interested in understanding the underlying formula, manually calculating NPV can provide deeper insights.

-

Understand the NPV Formula

- Learn the NPV formula and the significance of each component.

-

List Cash Flows and Time

- Put down the investment and return amounts along with their respective time periods on paper.

-

Perform Calculations

- Use the calculator to apply the NPV formula step by step.

Summary: This approach deepens comprehension and verifies the accuracy of automated functions. The downside is the time it takes and the room for manual error.

Programming Your TI-84 Plus for NPV

Advanced users may program their TI-84 Plus to calculate NPV with custom inputs.

-

Access Program Editor

- Use the calculator’s programming function to start a new program.

-

Write NPV Program

- Code the steps for NPV calculation using the programming language provided.

-

Execute Your Program

- Run the newly created program to calculate NPV.

Summary: Programming offers unparalleled customization and can speed up repetitive calculations, though it requires programming knowledge.

Memory Management for Calculations

Managing your TI-84 Plus’s memory is crucial to prevent data loss and ensure optimal performance during calculations.

-

Clear Previous Entries

- Remove old data to free up space and avoid confusion.

-

Backup Before Performing NPV Calculations

- Backup your data to protect against accidental loss.

Summary: Good memory management leads to smoother calculations, though it requires regular maintenance.

Efficient Use of Variables

Storing frequently used numbers as variables can speed up the NPV calculation process.

- Store Interest Rates and Cash Flows

- Use the

STO>function to save these values.

- Use the

Summary: Variables offer a quick retrieval of data, though it might be confusing without proper labeling.

Using Graphing Functionality

The TI-84 Plus allows for graphing cash flows over time, which can visually complement the NPV calculation.

-

Plot Cash Flow Data

- Enter data points into the

Stat Plotfunction.

- Enter data points into the

-

Analyze Graphical Data

- Observe the graph to glean insight into the cash flow trends.

Summary: Graphs provide visual insight but require an understanding of the graphing functions.

Conducting Sensitivity Analysis

Adjusting inputs and recalculating NPV can provide sensitivity analysis, giving you insight into how changes in variables affect the outcome.

- Alter Interest Rates or Cash Flows

- Change one variable at a time and recalculate NPV.

Summary: Sensitivity analysis highlights the robustness of the investment but can be time-consuming.

Regularly Update Software

Keep your TI-84 Plus’s operating system up to date to ensure the latest functions and stability for NPV calculations.

- Check for Updates Regularly

- Connect the calculator to your computer to download updates from the Texas Instruments website.

Summary: Updates provide new features and bug fixes but require access to a computer.

Referencing Official TI-84 Plus Manuals

Texas Instruments provides comprehensive manuals for their calculators.

- Download and Consult the Manual

- Use the official manual as a reference for complex calculations.

Summary: Manuals provide authoritative information while sometimes being dense and technical.

Calculating NPV is like planting seeds today to harvest value tomorrow. Each method yields its unique fruits, whether it’s the quick efficiency of the Finance Solver or the deep-rooted understanding from manual calculation. Modern tools like the TI-84 Plus augment your financial acumen, offering a blend of accuracy and intuition in forecasting the worth of your financial endeavors.

In conclusion, mastering NPV calculations on the TI-84 Plus requires a bit of practice, familiarity with finance fundamentals, and a systematic approach to using the calculator’s functions. Be it through a step-by-step method within the calculator’s finance application or a manual computation for a thorough understanding of the underlying principles, you now have the know-how to approach these calculations with confidence. Remember, getting comfortable with these processes can greatly enhance your financial decision-making skills.

Frequently Asked Questions

Q: Can the TI-84 Plus calculate NPV for irregular cash flows?

A: Yes, the TI-84 Plus can handle irregular cash flows using the Cash Flow (CF) function, where you can input different amounts for each period.

Q: What if my NPV result is negative?

A: A negative NPV indicates that the investment would result in a net loss based on the provided cash flows and discount rate. It suggests the investment may not be desirable unless further factors are considered.

Q: How often should I update my TI-84 Plus calculator software?

A: It’s good practice to check for updates once or twice a year, or before undertaking significant projects like a full semester of classes or a professional financial analysis, to ensure you have the latest features and fixes.