In today’s digital age, smartphones have become a hub for convenience, entertainment, and productivity. With millions of apps at our fingertips, it’s easy to get carried away with the vast offerings of the app stores, including in-app purchases that enhance our app experience. However, these purchases can add up quickly, and in certain situations—such as when a device is used by children—it’s important to manage and even disable these functions to prevent unexpected expenses. Whether you’re an Android or an iPhone user, taking control of in-app purchases can save you money and give you peace of mind. Let’s explore how you can easily turn off in-app purchases on your devices.

On Android: Using Google Play Settings

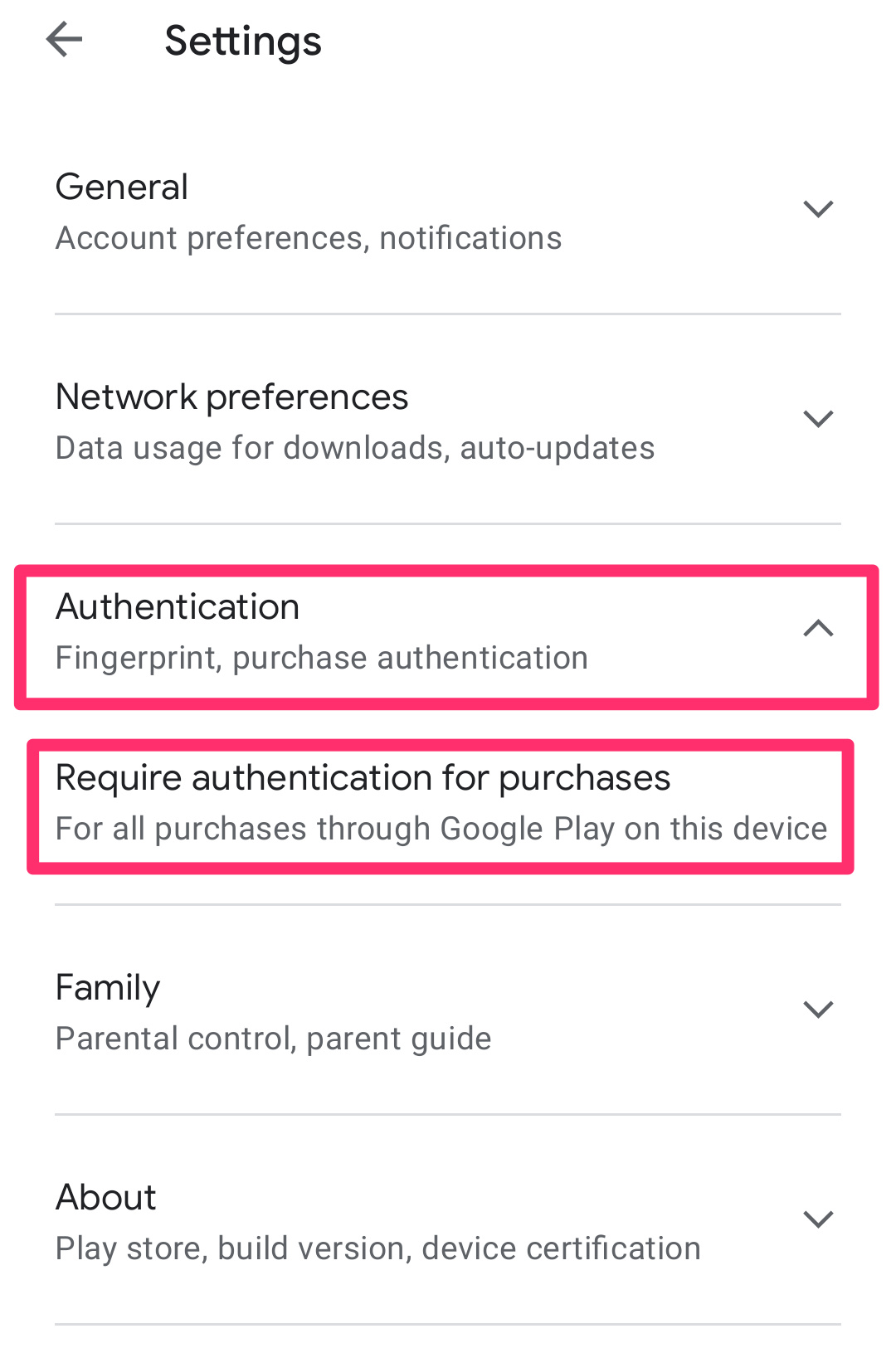

Most Android devices allow you to manage in-app purchases through the Google Play Store, which gives you control over your spending and prevents accidental purchases.

Detailed Steps:

- Open the Google Play Store app on your Android device.

- Tap the three horizontal lines (menu icon) in the top-left corner of the screen.

- Select “Settings” from the menu that appears.

- Scroll down and tap on “Require authentication for purchases”.

- Choose one of the options that suit your needs:

- For all purchases through Google Play on this device: This will require authentication for every purchase.

- Every 30 minutes: This allows a window where multiple purchases can be made without re-authentication for 30 minutes after an initial purchase.

- Never: This disables authentication, which is not recommended if you’re aiming to prevent in-app purchases.

- You will be prompted to enter your Google password to confirm the changes.

Summary:

Turning off in-app purchases on Android by adjusting your Google Play settings is a great way to prevent accidental or unauthorized purchases. The downside is that it adds an extra step for legitimate purchases, but the added security and control are usually worth this minor inconvenience.

On iPhone: Change Screen Time Settings

For iPhone users, preventing in-app purchases can be done through the device’s Screen Time settings, which include parental controls and restrictions for purchasing content.

Detailed Steps:

- Open the Settings app on your iPhone.

- Tap on Screen Time.

- If Screen Time hasn’t been set up before, you’ll need to tap “Turn On Screen Time” and follow the instructions. If it’s already on, proceed to the next step.

- Tap “Content & Privacy Restrictions” and enter your Screen Time passcode if prompted.

- Tap on “iTunes & App Store Purchases”.

- Tap “In-app Purchases”.

- Select “Don’t Allow” to turn off in-app purchases.

Summary:

By tweaking your iPhone’s Screen Time settings, you can effectively block in-app purchases, making it a reliable method for parents and individuals keen on avoiding accidental expenses. This method also blocks the ability to download apps, delete apps, and make in-app purchases, so ensure that these restrictions do not hinder your normal usage.

Creating a Stronger Authentication for Purchases

Setting a strong authentication requirement for each in-app purchase gives you a balanced approach between convenience and security.

Detailed Steps:

- Access the settings related to purchases on your device (Google Play Store settings for Android or Screen Time settings for iPhone).

- Choose to require authentication for every purchase.

- When prompted, enter your password or enable biometric authentication (fingerprint or face ID) for an added layer of security.

Summary:

Stronger authentication requirements ensure that every in-app purchase requires your explicit approval. It’s a practical solution for those who want to keep the functionality but add a safety net. However, it might be slightly inconvenient to input authentication details for each transaction.

Family Group Setup for Controlled Purchases

On both Android and iPhone, you can set up a family group that enables you to approve or decline purchase requests from family members, like children.

Detailed Steps on Android:

- Open the Google Play Store app and tap the menu.

- Tap on “Account” and then “Family”.

- Follow the prompts to set up a Family Library.

- Once set up, you can manage purchase approvals under “Family management” settings.

Detailed Steps on iPhone:

- On your iPhone, go to Settings.

- Tap on your Apple ID and choose “Family Sharing”.

- Follow the instructions to set up your family group and enable “Ask to Buy” for younger family members.

Summary:

Creating a family group can provide a collaborative way to manage in-app purchases, with the ability for other family members to request purchases that you can approve or deny. The downside is that setting up a family group takes a few more steps and is best suited for managing children’s purchases rather than your own.

Monitoring and Limiting Use with Budget Apps

Using third-party budget apps or built-in features on your smartphone can help you monitor and limit your in-app spending.

Detailed Steps:

- Find and download a reputable budgeting app that allows for tracking in-app purchases.

- Set up your account and link it to your payment methods used for in-app purchases.

- Set budgets and alerts to keep your spending in check.

Summary:

Using a budgeting app can give you a clear view of your spending habits and provide alerts when you’re nearing your set limits. While this doesn’t directly prevent in-app purchases, it encourages responsible spending and awareness.

Keeping Payment Information Private

Avoid storing payment information on your device to reduce the ease of making in-app purchases.

Detailed Steps:

- Go to the payment information section in your device’s store settings.

- Remove your credit card or PayPal information.

- Confirm any prompts asking to save changes.

Summary:

Removing payment information can effectively prevent spur-of-the-moment in-app purchases because you’d need to enter payment details manually each time, adding a layer of deliberation to the process. The downside is the inconvenience for other types of transactions.

Educating Others Who Use Your Device

If others use your smartphone, teaching them the importance of managing in-app purchases and the impact they can have on finances is essential.

Detailed Steps:

- Sit down with the other users of your device and discuss the topic of in-app purchases.

- Explain the procedure for making a purchase and why it needs deliberation.

- Set ground rules for when and how in-app purchases should be made.

Summary:

Educating other device users promotes responsible use and helps prevent unwanted purchases. This requires trust and communication and is not a foolproof method, especially with younger children.

Checking In-App Purchases Regularly

Regularly reviewing your in-app purchases can help you be more mindful and recognize any patterns or problem areas.

Detailed Steps:

- Access purchase history in the app store settings of your device.

- Review the list of past in-app purchases.

- Look for recurring or unnecessary purchases that you can avoid in the future.

Summary:

This habit can make you cognizant of your in-app spending trends but requires self-discipline and doesn’t prevent purchases proactively; it’s more of a retrospective tool.

Understanding Apps and Their Monetization Strategies

Learn about the different ways apps monetize, such as ads, in-app purchases, or subscriptions, to make informed decisions before downloading them.

Detailed Steps:

- Read the app description and reviews carefully to understand its monetization model.

- Decide if the app’s monetization strategy aligns with your preferences and values.

Summary:

This knowledge empowers you to choose apps wisely, potentially avoiding those that heavily rely on in-app purchases. However, finding alternatives to popular apps can sometimes be challenging.

Enabling Airplane Mode When Necessary

In situations where you want to prevent all types of transactions, enabling Airplane Mode can be an effective temporary solution.

Detailed Steps:

- Slide down the notification shade on Android or go to the Control Center on iPhone.

- Tap the airplane icon to enable Airplane Mode.

Summary:

While this prevents in-app purchases, it also cuts off all network connectivity, which could restrict normal device usage.

Understanding how to manage and turn off in-app purchases gives you control over your digital expenses and can help in creating a distraction-free environment. It’s essential to tailor these options to fit your lifestyle, and to balance the act of securing your finances with the enjoyment and utility offered by your apps. When done right, you can harness the best of both worlds—embracing modern app conveniences while keeping your spending in check.

Conclusion

In a world where apps are increasingly woven into the fabric of our daily lives, it’s important to stay mindful of the potential financial pitfalls they present. Turning off in-app purchases is a straightforward process whether you’re using an Android or an iPhone, and it can lead to significant savings and peace of mind. We hope this guide has helped illuminate the steps you can take to safeguard against unintended expenditures and to take control over your digital and financial well-being.

FAQs

Q: Will turning off in-app purchases affect my ability to update existing apps?

A: No, turning off in-app purchases does not affect your ability to update apps. App updates and in-app purchases are managed separately in both the Google Play Store and the Apple App Store.

Q: Can I turn off in-app purchases temporarily?

A: Yes, you can change your in-app purchase settings at any time to enable or disable the functionality as needed.

Q: If I remove my payment methods to prevent in-app purchases, will it affect my subscription services?

A: Removing payment methods from your app store account may affect any ongoing subscriptions that rely on that information for renewal. It’s best to check with the subscription service provider for details on how to manage payments.